When it comes to financial planning, I’m a huge fan of a Google Sheets budget template. I use them personally and for my business. My preferred spreadsheet helps me track spending and multiple income streams. While I know how to make a budget spreadsheet, having free templates saves me a lot of time.

In this article, I’ll show you the best free Google Sheets budget template. I’ll also show you other options, all of which are free, and how to use them. Finally, I’ll cover which fundamentals to include if you decide to create a budget template yourself.

Table of Contents

What Is a Budget Template?

Without a way to organize financial information, it’s challenging to keep an eye on funds. A budget template is a file used to track your spending habits and income, as well as plan your finances (which is usually more appropriate for longer-term forecasts). Simply put, a budget template is ideal for seeing where your money is going.

Do I Need a Google Sheets Budget Template?

If you’re struggling to balance finances, a budget spreadsheet goes a long way to identify potential reckless spending. It’s also great for individuals who want to organize their finances, get “in the black,” or start a business.

Maybe you need to start saving for retirement. Maybe you need to set aside extra cash for potential emergencies. Whatever the reason, financial transparency is the key!

The 7 Best Free Budget Templates for Google Sheets

Not sure how to create a spreadsheet for your budgeting goals? Don’t worry! I’ve compiled some of the best templates anywhere. Each of these free Google Sheets budget templates is user-friendly and easy to access. All you have to do is download a copy, fill out the necessary details, and you’re done!

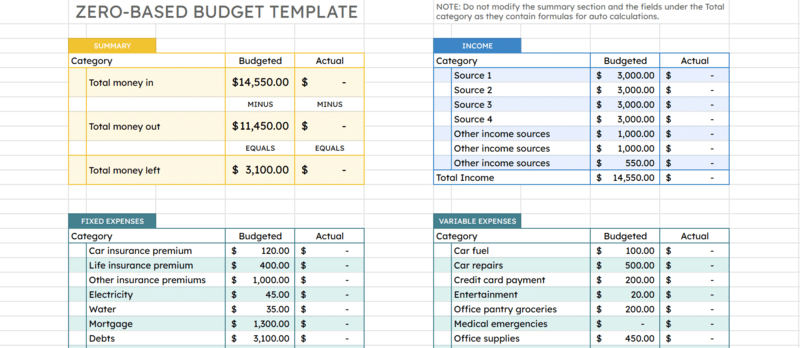

1. Zero-Based Budgeting Template for Google Sheets

One popular budgeting technique is the idea of “zero-based.” It’s a very popular way to organize personal finances, and the concept is simple. With a zero-based budget, you allocate all your net income into planned expenses until their difference becomes zero. This is a great way to ensure your hard-earned funds are spent wisely. More importantly, a zero-based budget template helps plan for savings goals.

Note that you can also use it for business transactions. Let’s say you have a startup capital of $20,000 for your soap business. You’d list all crucial operational expenses (like material acquisition, logistics, and marketing). You’ll continue until the budget is exhausted.

Our zero-based budgeting template is easy to use, displaying the total income you’ve generated and comparing it against the total allocated funds. You’ll also see the remaining balance that you’ll need to divide further. Best of all, you can use it for business and individual budgeting!

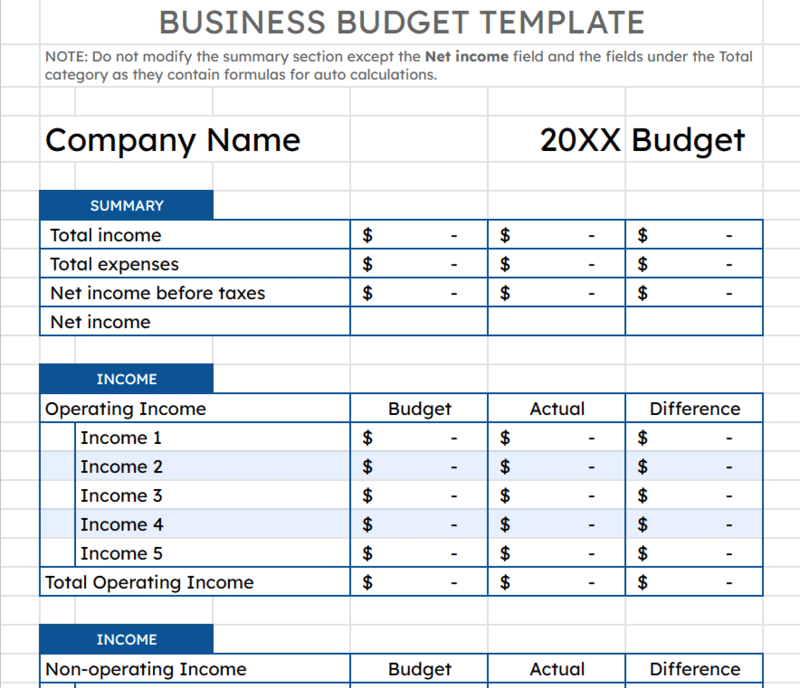

2. Simple Business Budgeting Template for Google Sheets

One of the most important aspects of any business is how its funds flow (i.e., money generated, spent, gained). If you’re in the early years of your enterprise, organizing your income and expenses in a simple budget sheet will provide clearer insight into budget strategy. It’s an essential part of any business plan, and a balanced budget also helps small-business owners plan for the future.

To use this budget template, divide your operating income and expenses into separate categories, and enter each into the Income rows. You can even connect this to another sheet, so it automatically pulls data. Of course, static figures would turn this into a printable budget spreadsheet Google Sheets template instead. Whether you use it online or offline, it’s a good fit for small businesses with multiple streams of income.

Start by listing the money received from various income sources. This might include your company’s profits and gifts received from others. Next, do the same for your expenses. The template will automatically tally your numbers. Since this simple Google Sheets budget template is customizable, feel free to include the company name and year for a more official-looking report.

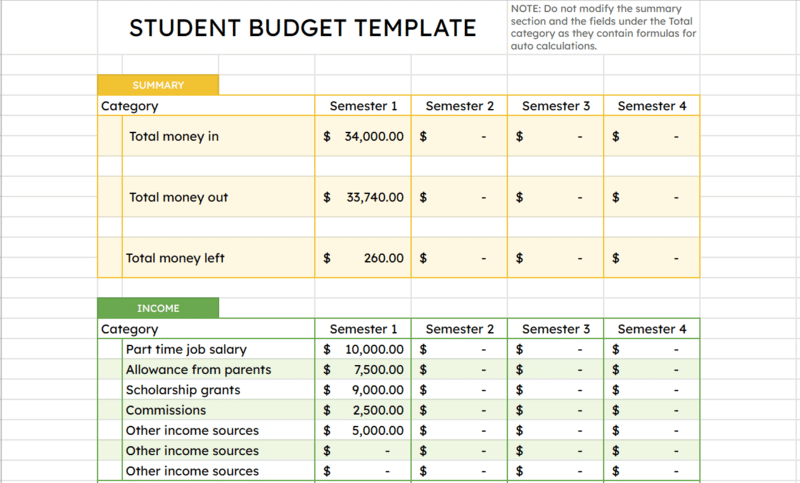

3. Google Spreadsheet Budget Template for Students

Learning how to budget your finances as a student can go a long way to saving money for your future. It can also help you pay back student loans more quickly. And, if you’re familiar with the power of compounding interest, you’ll understand why that’s such an appealing idea.

Being responsible for your finances can be a bit overwhelming initially, but you should know that budgeting doesn’t have to be complicated. In our student-friendly Google Sheets budget template, start by listing your total income. That might include part-time work, scholarship grants, internship stipends, or even an allowance from especially generous parents.

Next, include your regular expenses to create a more comprehensive budget planner. Our free budget spreadsheet features four phases (from semester 1 to 4), categorizing the expenses you typically require as a student. That means you’ll have somewhere to include tuition payments, anticipated book costs, and any other planned educational expenses.

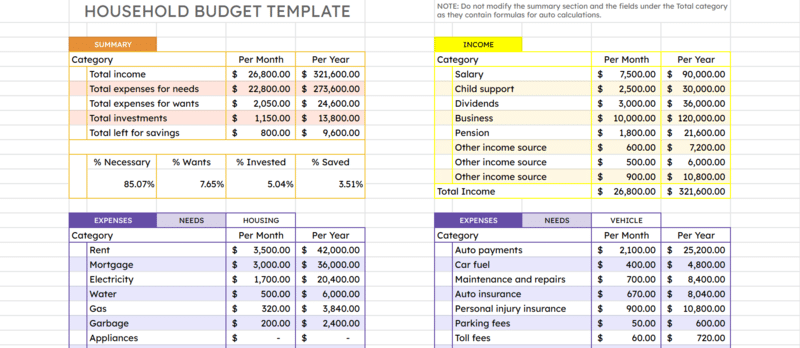

4. Simple Household Budgeting Template

While most of the best budget templates above work for businesses, we wanted to make sure we included a top option for household finances, too. That’s where this one comes in. This free budget spreadsheet lets you determine your remaining funds after buying all your living expenses.

It comes pre-filled with regular housing expenses (e.g., property tax, mortgage), kids’ school costs, groceries, auto payments, utilities, and more. There’s also a section for allocating money for your wants and investments. We’ve also built our own custom budgets for our own families using this template. In our personal breakdowns, we added additional “spend” categories for savings goals. You may want to edit this Google Sheets budget template to include a house fund, travel fund, or education fund.

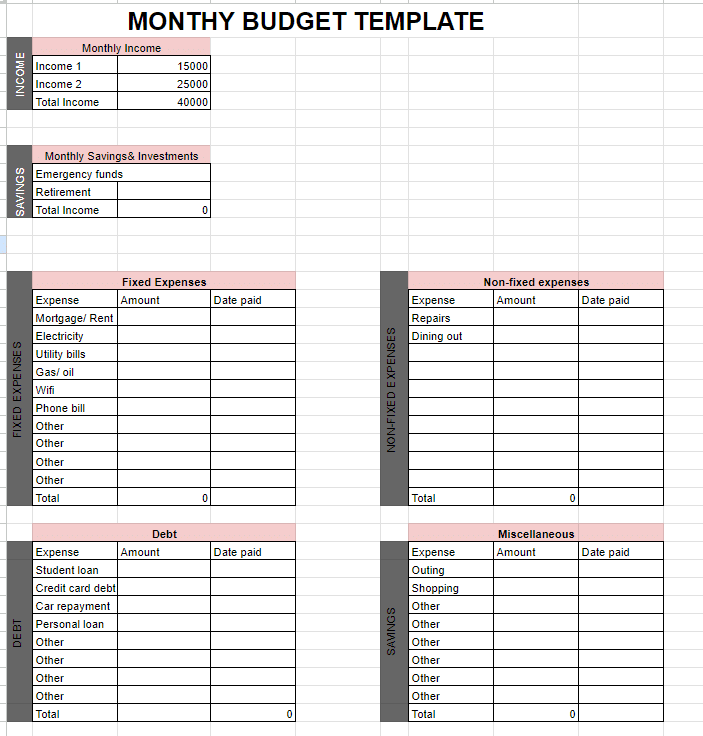

5. Monthly Budget Template for Google Sheets

This monthly expenses spreadsheet is a simple template that’s divided into different categories. It comes pre-populated with common budget elements (e.g., income, rent), but it’s easy to customize them to suit your specific financial needs and priorities.

Like our other templates, this free Google Sheets template includes formulas to automatically calculate totals for your income plus expenses under each category. This should provide a much clearer overview of your personal monthly budget.

Pro tip: This template is simple and adaptable for any Google Sheet budgeting purposes – from business to household.

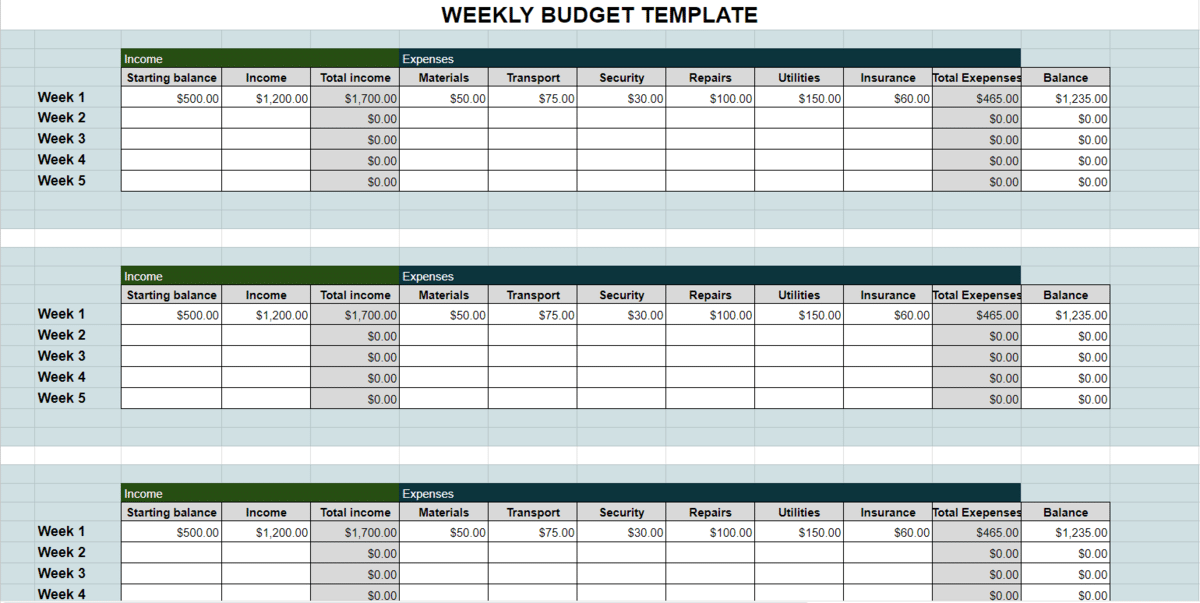

6. Weekly Budget Template for Google Sheets

This free weekly budget template is a simple, user-friendly document. As you incur expenses throughout the week, record the amounts spent under each category. This template helps you monitor your spending in real time and stay within your budget limits. There are dedicated cells to enter expenses and multiple sources of income (e.g., salary, freelance).

The template utilizes built-in formulas to automatically calculate the total income, total expenses, and balance for each week. We recommend this weekly template for efficiently managing your finances, staying accountable to your financial goals, and making well-informed decisions.

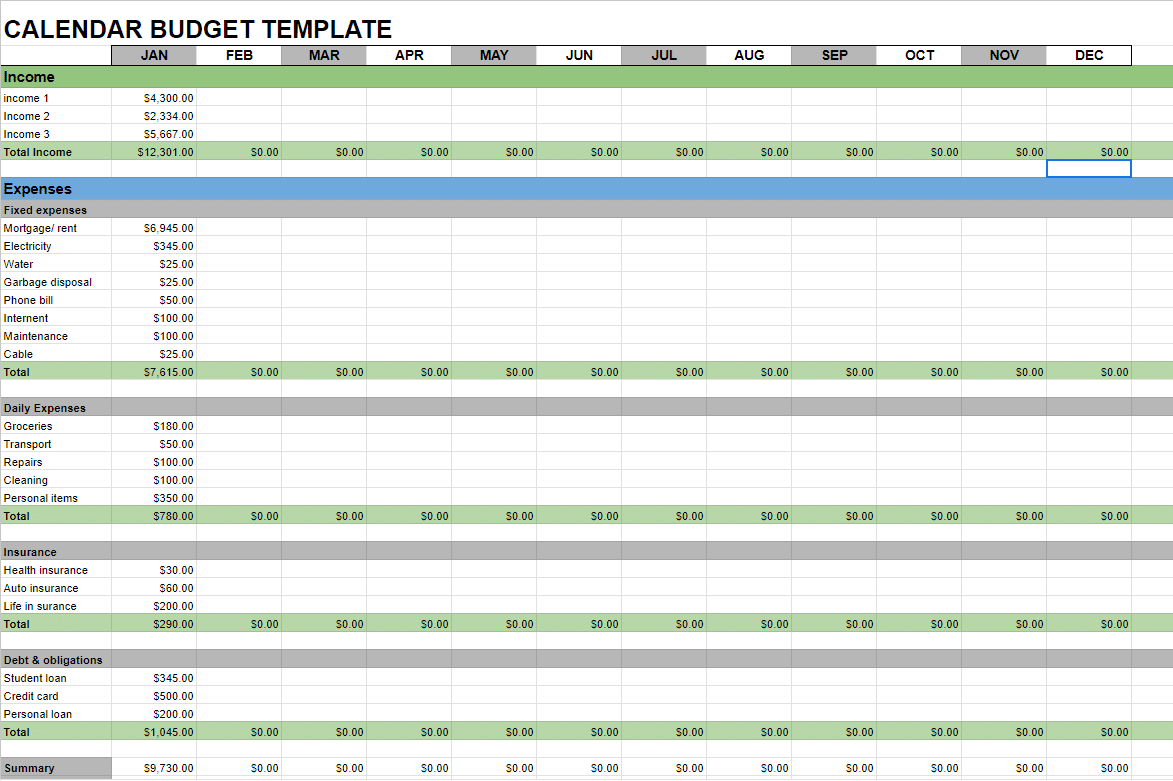

7. Annual Budget Calendar Template

This Google Sheets calendar budget template is a versatile, user-friendly tool designed to help you track your annual finances. Each month, you’ll input your income and budget amounts into dedicated categories.

With built-in formulas, this document automatically calculates totals for each category’s planned and actual expenses. This eliminates manual calculations and ensures more accurate budget tracking.

The template also includes a summary that consolidates data from each monthly sheet, adding a holistic view of your yearly financial progress at the bottom. Use this template as a personal, family, or business spreadsheet!

Related: Top 10 Google Sheets Calendar Templates

How to Create a Custom Budget Spreadsheet

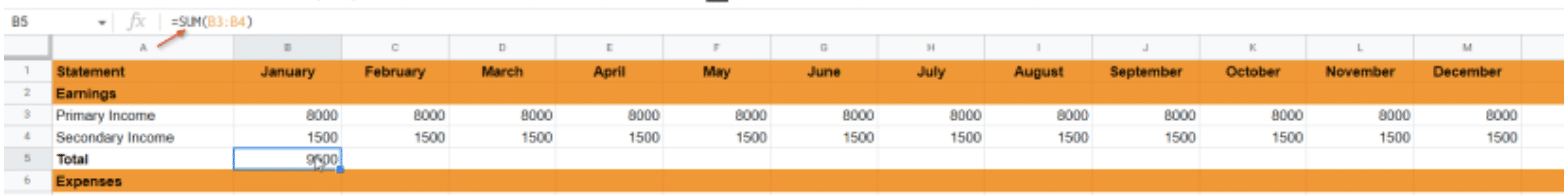

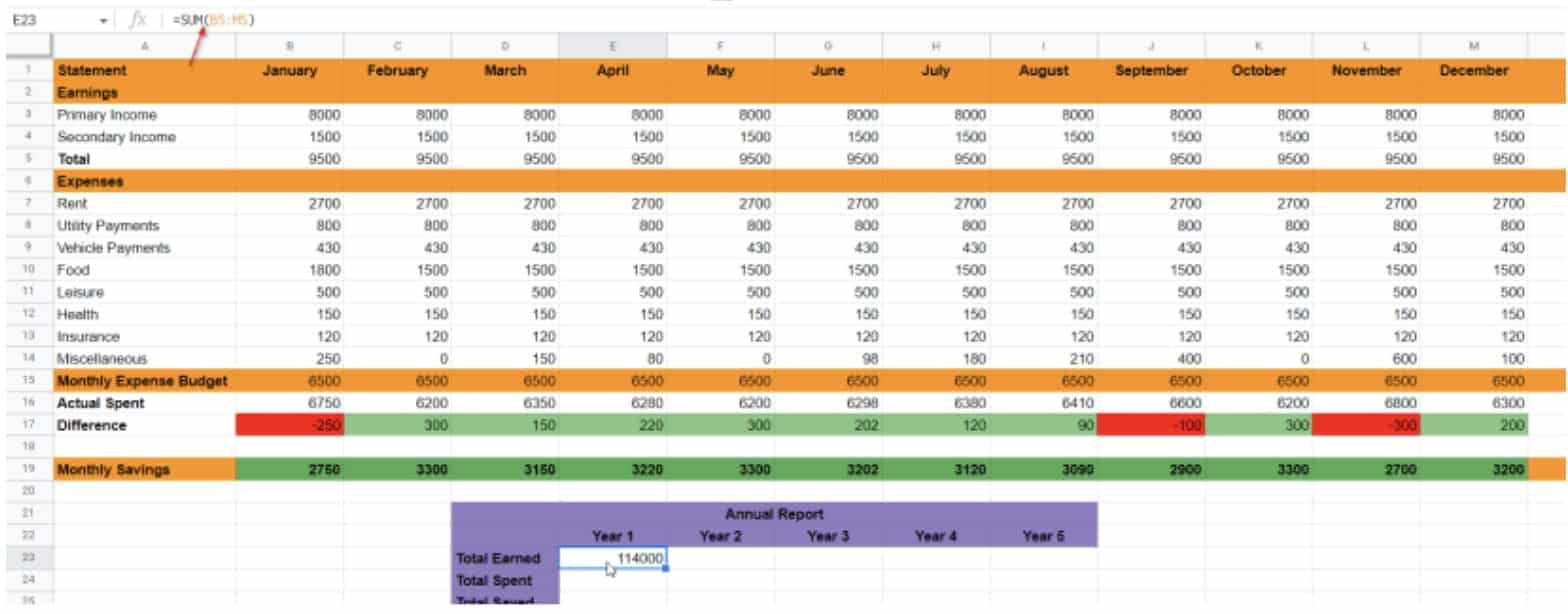

The following annual template is comprised of monthly earnings, expenses (e.g., rent, utilities, vehicle payments), budget, and savings from January to December.

Calculating Monthly Budget

- Fill in all your data in the template sheet.

- Calculate the total earnings using the =SUM function

- Drag the function forward to all other cells.

- Calculate the actual spent value using the =SUM function

- Drag the function forward to all other cells.

- Use the =MINUS function to calculate the difference between your budget and the actual spent value.

- Drag the function forward to all other cells.

- Calculate the monthly savings using the =MINUS function

- Drag the function forward to all other cells.

Conditional Formatting

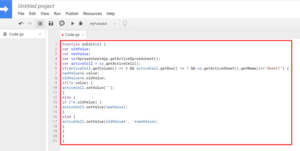

In line 17 (in the above screenshot), you’ll notice that surplus and deficit automatically change color. Deficits turn red and surpluses turn green, thanks to conditional formatting in Google Sheets. To add this feature to your own Google Sheets budget, select the cells and choose Format > Conditional Formatting. When entering the conditions:

- As a first condition, choose to color the cell red if the value is less than one.

- As a second condition, choose to color cells green if they have a value of one or higher.

Calculating Annual Budget

- Calculate the total earned using the =SUM function.

- Calculate the total spent using the =SUM function.

- Calculate the total saved using the =MINUS function.

You’ve officially set up a budget spreadsheet of your own!

Benefits of Using a Google Sheets Budget Template

Admittedly, these benefits really depend on how you use your budget spreadsheet template. But there are a few tangible benefits that you can gain by using one:

- Organized finances: Most budget templates feature various categories that help you organize your money flow.

- Automated computations: Google Sheet budget templates often include built-in formulas that automatically update as details are entered or modified (e.g., instant sums, percentage of total income).

- Collaboration features: Google Sheets supports easy sharing and collaboration. This is ideal if you need a partner or team to assist with budgeting.

- Setting spending limits: If you’re using a zero-based budgeting template, you’ve already allocated every dollar in your wallet and account. This visualization will help you avoid going over the set amount.

- Reaching your financial goals: A budgeting spreadsheet template can go a long way to accumulate savings.

Related: Want to increase your salary? Coursera online classes can take your skills to the next level!

What Should a Good Budget Template Have?

There aren’t really specific benchmarks for budget templates. They can be as simple as listing your expected salary minus the few general payments you have to make. But if you’re planning to create your own budget spreadsheet, here are some nice-to-haves that the best budget templates for Google Sheets should include:

- Specific categories for your income and expenses: Track your outflow and inflow of money, brainstorm possible money sources, and keep tabs on important payments.

- Functions and formulas: Create a template that automatically calculates the funds you’ve spent and gained. This keeps you from adding the funds one by one.

- Colors for separate categories: While this is optional (and relies on your preferences), you may want a template that utilizes different colors for each category.

Frequently Asked Questions

Does Google Sheets Have a Budget Template?

Yes, Google Sheets has a few budget templates to choose from. In the template gallery, scroll to the “Personal” category. There are only two options available for you to choose from: Monthly and annual budgeting.

If these don’t meet your requirements, it’s easy to create a customized template or download one of our pre-made templates!

Is Google Sheets Good for Budgeting?

Generally speaking, spreadsheets are excellent for managing your finances. Google Sheets, however, is a free budgeting app that allows for easy collaboration and sharing with colleagues.

How Do I Create a Budget in Google Spreadsheet?

The easiest way to create a budget is with one of our existing Google Sheets budget templates. They contain everything you need to track income and expenses. You can even customize them to suit your personal financial goals.

Can You Use Excel to Create a Budget?

Yes, you can use any spreadsheet software to track your finances. Like Google Sheets, there are multiple Excel budget templates that include all of the same information (though they’re formatted for Microsoft Excel).

Is There a Free Budget Template?

Yes, there are several free budget templates. While my top picks are all Google-based (choose a free budget tracker in Google Sheets above), I also recommend checking out Excel, Notion, and Smartsheet.

Final Thoughts

Managing your money in a clear and organized manner is one of the most important elements for individuals and businesses alike. To gain more control of your finances, one of these Google Sheets budget templates is sure to help you!

Related: