For many businesses, tracking financial performance is essential, but not every company opts for expensive accounting software to do so. Instead, a significant number rely on Microsoft Excel to prepare their financial statements.

Despite the rise of cloud-based accounting platforms with automation and built-in compliance features, Excel remains a go-to tool for entrepreneurs, small businesses, and even some larger organizations. Its flexibility, cost-effectiveness, and ease of use make it an attractive option for those who prefer direct control over their financial data.

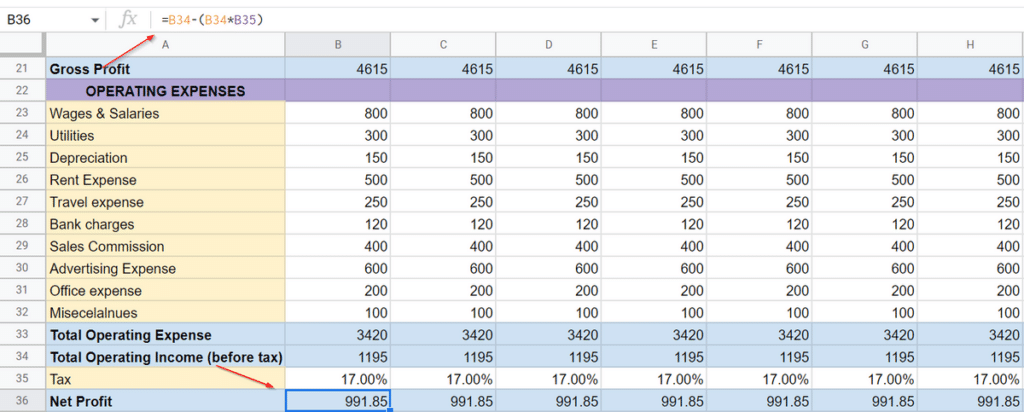

And Excel isn’t the only option. For example, here’s a free income statement template for Google Sheets. It’s easy to make one from scratch, too.

An Inexpensive Alternative to Accounting Software

One of the primary reasons businesses prefer Excel over accounting software for preparing income statements is cost savings. Many small businesses operate on tight budgets, and the expense of accounting software—often requiring monthly or annual subscription fees—can be a financial burden.

Programs like QuickBooks, Xero, and FreshBooks may offer powerful features, but those costs quickly add up, especially when factoring in additional fees for multiple users, advanced reporting, or integration with other business tools.

That’s why many small businesses default to Excel for accounting. It’s a one-time investment. It’s also included with Microsoft Office packages that many businesses already own. It also has a bunch of spreadsheet templates made especially for business.

Even free alternatives, such as Google Sheets, provide similar income-tracking capabilities without cost. For companies with straightforward financial tracking needs, the price of accounting software may not justify the benefits, making a simple spreadsheet a more economical choice.

Customization

Cost isn’t the only reason small businesses still use Excel. Prebuilt templates in software programs can be restrictive, forcing companies to conform to standardized reporting structures that may not align with their specific needs.

With Excel, businesses have full control over the layout, formulas, and data presentation, allowing them to create reports that reflect their unique financial situation.

Here’s an example: Say you run a business that has industry-specific expenses and revenue streams, something really specific and unusual. Accounting software might not be set up for that. But your team can build a bespoke option specifically for your business.

And some users can also connect Python to Excel. That amplifies the power of this already powerful spreadsheet software, so businesses can more effectively analyze revenue and expenses.

Those just getting started may want to try a few Python projects to build their skills. Note that you don’t need to be a professional coder to use this language. It’s pretty easy to get started.

And with AI coding assistants, many Excel users can get by just fine without being able to write an entire program from scratch.

This level of adaptability makes Excel an invaluable tool for businesses that need to tailor their financial reporting to their own operational requirements.

Data Privacy

And on the subject of amplified power with tools like Python, there are also ways to automate data cleaning in Excel. This requires a bit of time to set up, but once it’s ready it’s made especially for your accounting team.

That brings us to privacy. Many small businesses store income statements locally on their own devices or internal servers. That keeps sensitive financial data entirely within their control.

It also eliminates concerns about third-party access, hacking risks, or unauthorized data sharing. Companies operating in industries with strict compliance regulations, such as finance, healthcare, or government contracting, may prefer the certainty of local storage over cloud-based solutions that could introduce compliance challenges.

This added level of control can be especially important for small businesses that lack dedicated IT teams but still want to ensure their financial data remains private and protected from external threats.

There are plenty of reasons small businesses use Excel for income statements, but the main reasons are still cost, customization, and privacy.

Looking for your own financial spreadsheet templates? Visit SpreadsheetPoint.com to download customizable finance templates today!