Tracking your stock portfolio effectively is crucial for understanding performance, identifying trends, and making informed investment decisions. Fortunately, Excel offers an excellent platform to build a custom portfolio tracker.

You can access our Excel stock tracker here (just make a copy for yourself).

Here’s a detailed breakdown of how to create one:

Step 1: Create the Structure

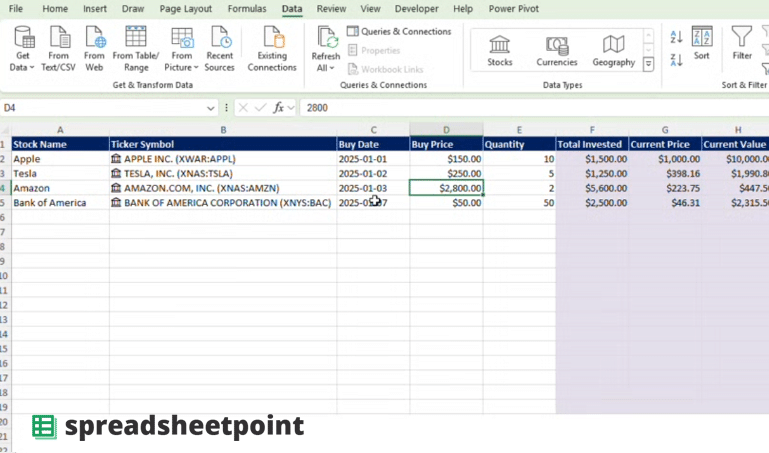

The foundation of any effective tracker lies in its structure. Start by creating a new Excel workbook and adding the following headers to Row 1:

- Stock Name (Column A): The name of the stock (e.g., Apple, Microsoft).

- Ticker Symbol (Column B): Stock market ticker symbol (e.g., AAPL, MSFT).

- Buy Date (Column C): Date you purchased the stock.

- Buy Price (Column D): Price per share at the time of purchase.

- Quantity (Column E): Number of shares purchased.

- Total Invested (Column F): The total amount invested.

- Current Price (Column G): The latest stock price.

- Current Value (Column H): The current value of your holdings.

- Gain/Loss ($) (Column I): Dollar amount of your profit or loss.

- Gain/Loss (%) (Column J): Percentage change in the value of your investment.

Step 2: Input Static Data

Now, populate the columns with information specific to your portfolio:

- Stock Names (Column A): Enter names such as “Apple” or “Microsoft.”

- Ticker Symbols (Column B): Input the respective stock ticker symbols.

- Purchase Date (Column C): Add the buy date for each stock.

- Buy Price (Column D) & Quantity (Column E): Fill in the price paid per share and the number of shares purchased.

Step 3: Add Formulas

To automate calculations, add these essential formulas:

- Total Invested (Column F):

=D2*E2

Calculates the total cost of buying the stock. - Current Value (Column H):

=G2*E2

Multiplies the current stock price by the number of shares. - Gain/Loss ($) (Column I):

=H2-F2

Computes the profit or loss in dollar terms. - Gain/Loss (%) (Column J):

=(I2/F2)*100

Shows the percentage change from the original investment.

Step 4: Fetch Current Prices

To keep your tracker dynamic, update the Current Price (Column G) regularly. Here are two methods:

- Using Excel’s Stock Data Type:

- Highlight the ticker symbols in Column B.

- Navigate to the Data tab and click on Stocks.

- Use the dropdown menu to populate the Current Price (Column G) automatically.

- Using Advanced Methods:

- Integrate APIs or use a VBA script to fetch live prices for real-time updates.

Step 5: Formatting and Visualization

Make your tracker visually intuitive:

- Number Formatting: Use currency formatting for price and total columns and percentage formatting for Gain/Loss (%).

- Conditional Formatting: Highlight gains in green and losses in red for quick visual insights.

- Summary Section: Add key metrics at the bottom or in a dedicated summary area:

- Total Portfolio Value:

=SUM(H2:H100) - Total Gain/Loss ($):

=SUM(I2:I100) - Total Gain/Loss (%):

=(SUM(H2:H100)-SUM(F2:F100))/SUM(F2:F100)*100

- Total Portfolio Value:

Step 6: Save and Update Regularly

Once your tracker is complete:

- Save the file in a secure location.

- Update Current Price (Column G) regularly for accurate portfolio monitoring.

Why Use an Excel Portfolio Tracker?

Creating a stock portfolio tracker in Excel offers unparalleled customization and control. While many apps provide pre-built tracking tools, Excel lets you tailor every detail to your needs. Whether you’re a beginner investor or a seasoned trader, this tracker gives you insights into your financial journey.

By following these steps, you’ll have a powerful tool to manage your investments efficiently. Whether you’re tracking a handful of stocks or managing a diversified portfolio, this Excel tracker ensures you stay on top of your financial goals.

Note that we also have a guide on how to import historical prices.