Economic uncertainty is a constant in the modern world, but the question on many minds in 2025 is clear: Are we in a recession? While the headlines may stir fear, the reality is more nuanced. Understanding whether an economy is in recession requires looking beyond media narratives and analyzing key indicators like GDP growth, employment rates, consumer spending, and market behavior.

Traditionally, a recession is defined as two consecutive quarters of negative GDP growth. However, the National Bureau of Economic Research (NBER), the organization responsible for officially declaring recessions, uses a broader set of criteria. In addition to GDP, factors such as employment trends, industrial output, and corporate earnings play a role in determining whether the economy has entered a downturn.

Key Economic Indicators: What’s Happening Now?

Several data points suggest the economy is experiencing turbulence, but does it meet the criteria for a recession?

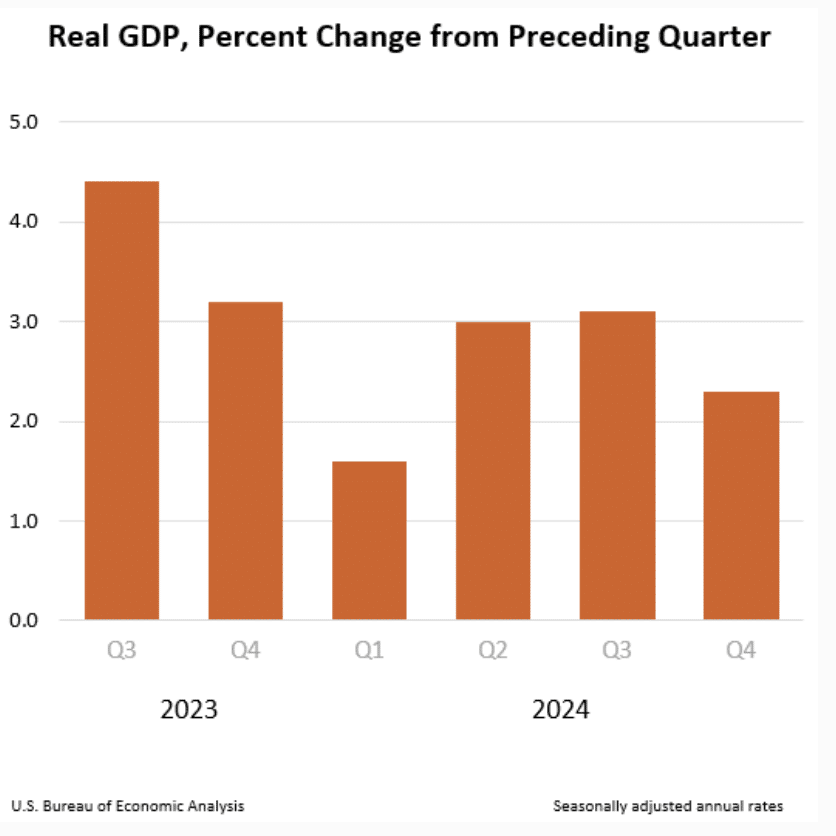

The U.S. economy showed signs of potential recession as GDP contracted in the fourth quarter of 2024. While first-quarter data for 2025 remains incomplete, a second consecutive decline would reinforce concerns of an economic downturn. Analysts are closely monitoring key indicators to assess the depth and duration of any potential slowdown.

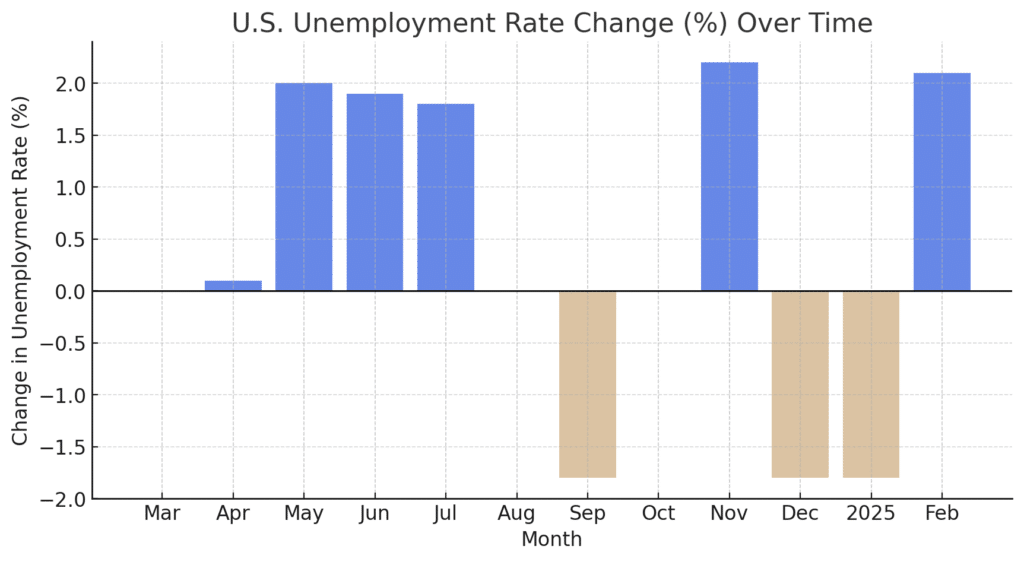

The labor market has experienced considerable volatility over the past year. Unemployment saw sharp increases in mid-2024 and early 2025, with seasonal hiring providing only temporary relief. The post-holiday period has revealed rising joblessness outside of typical seasonal patterns, raising concerns about broader economic weakness.

Stock markets have reflected growing uncertainty, with investors reacting sharply to economic turbulence. A three-week selloff sent the S&P 500 down nearly 9 percent, while the Nasdaq Composite fell around 14 percent. High-growth technology companies, including Tesla, NVIDIA, and Meta, bore the brunt of the downturn as investors pulled back from riskier assets in favor of more stable investments.

Investor sentiment has turned increasingly cautious, as evidenced by a sharp rise in the CBOE Volatility Index (VIX), which reached its highest level since December. At the same time, falling treasury yields suggest a flight to safety, as market participants seek protection against potential economic deterioration.

Adding to economic uncertainty is a shift in tariff policy as President Trump takes office following President Biden’s departure. Businesses are already adjusting their forecasts in anticipation of potential trade disruptions, as new policies could reshape key economic relationships.

The uncertainty surrounding these changes has left markets unsettled, with investors and corporate leaders bracing for possible shifts in global trade dynamics. And this isn’t the first time. Markets always react after presidential inaugurations (just not always this negatively).

Are We in a Recession?

Based on the data, the economy is showing clear signs of stress, but it may not yet meet the official definition of a recession. This is confirmed by a data scientist from Hackr.io. The GDP numbers point to a slowdown, and rising unemployment and investor anxiety suggest potential trouble ahead.

The uncertainty surrounding tariffs and government spending reductions further complicates the picture. Even Treasury Secretary Besson has warned of a potential “detox period” as the government slashes government services. That’s not to mention billionaire Elon Musk and his work with DOGE.

There’s a video that breaks down this same information on the Spreadsheet Point YouTube Channel. In it, Dr. Johns explains the considerations when determining whether or not we’re already in a recession.

So what can we do to prepare? Recession or not, economic uncertainty requires smart financial planning. For those concerned about a recession this year, there are several considerations.

The job market: If layoffs increase, that could signal deeper economic issues for this year and beyond.

Interest rates: Rising rates could mean more expensive loans. That means higher monthly mortgage payments for new home purchases and refinances. But the fed may be hesitant to raise rates if inflation abates.

So, are we in a recession?

The data suggests that while the economy is under pressure, it has not yet fully entered a recession. However, the combination of slowing growth, rising unemployment, and market volatility indicates that economic stress is building. The best strategy for individuals is to stay informed, track key indicators, and make smart financial decisions.

As the economic landscape continues to shift, understanding the signals, rather than reacting to fear-driven headlines, remains the best way to navigate uncertain times.

For more interesting takes on the data behind today’s news, visit Spreadsheet Point.