Rep. Alexandria Ocasio-Cortez is drawing a line in the sand. If the artificial intelligence boom ends in a crash, she argues that taxpayers should not be forced to bail out the companies that fueled it. Her warning sounds rhetorical until you run the numbers and compare today’s AI valuations with the scale of the 2008 financial crisis bailouts.

The United States has been here before. In 2008, Congress approved the Troubled Asset Relief Program, known as TARP, to stabilize collapsing banks, the auto industry, and AIG. The Treasury ultimately disbursed about 443.5 billion dollars under TARP and recovered almost all of it, leaving a lifetime net cost of 31 billion dollars.

Those figures come from the Government Accountability Office’s 2023 report “Troubled Asset Relief Program: Lifetime Cost”, which summarizes how the program was authorized for up to 700 billion dollars but ended with a much smaller net cost for taxpayers.

Those figures were politically explosive at the time. Today, they are smaller than what a partial rescue of the AI sector could look like on paper.

How big is the AI bubble in dollar terms?

Start with the companies most exposed to the AI buildout. Nvidia is now one of the world’s most valuable public companies, with a market capitalization around 4.7 trillion dollars. Microsoft sits near 3.9 trillion, Alphabet around 2.9 trillion, Amazon roughly 2.3 trillion, and Meta close to 1.8 trillion. On top of that, OpenAI carries a private valuation of about 500 billion dollars after its latest secondary share sale, and Anthropic’s valuation has climbed into the 350 billion dollar range after major investments from Microsoft and Nvidia.

Put those seven names together and you are looking at roughly 16.6 trillion dollars in equity value concentrated in a single cluster of AI platforms, chip suppliers, and hyperscale cloud providers. That is not the entire AI universe, but it is the part most likely to be treated as systemically important if things go wrong.

For readers who want to see how these exposures look in a real spreadsheet, a simple stock portfolio dashboard can go a long way. A step-by-step guide like this stock portfolio tracker in Excel tutorial offers a concrete way to map positions, simulate drawdowns, and visualize how a sudden drop in AI valuations would hit an investor’s balance sheet.

No one knows what an AI crash would actually look like, so any bailout estimate is a scenario, not a forecast. To keep the math transparent, assume the following by 2026:

- The AI sector centered on these firms loses 50 percent of its combined value.

- The federal government steps in to backstop 10 percent of the current combined market cap of these firms, effectively covering about 20 percent of the losses.

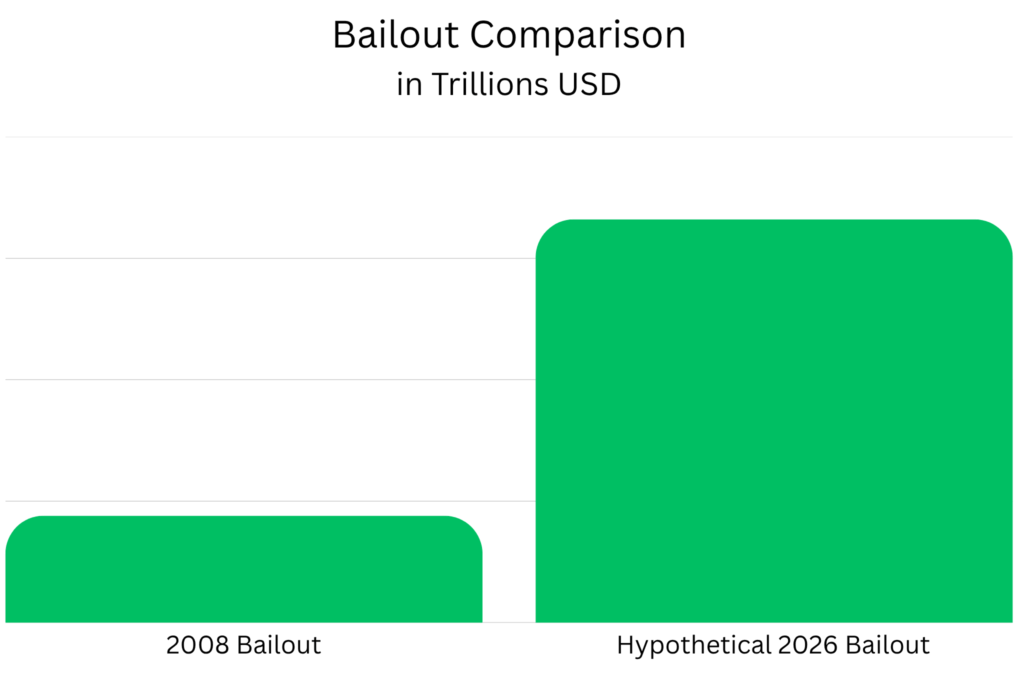

Ten percent of 16.6 trillion dollars is about 1.66 trillion dollars. That is more than three times the total direct cost of the 2008 crisis bailouts on a fair value basis and nearly four times the amount that Treasury actually disbursed under TARP.

The table below lays out the comparison.

| Program | Approx size (USD) |

|---|---|

| 2008 TARP disbursements | 0.44 trillion |

| Total 2008 crisis bailouts (fair value) | 0.50 trillion |

| Combined market cap of key AI players (2025) | 16.56 trillion |

| Hypothetical 2026 AI bailout at 10 percent of that | 1.66 trillion |

This is not special modeling. It is one spreadsheet line: pick a bailout share of the current AI market cap. Even at a modest 10 percent, the public commitment quickly climbs into the low trillions.

Is this really a “2008 style” threat?

AOC’s language is pointed. In her recent comments, reported by Common Dreams, she warned that an AI crash could bring “2008 style threats to economic stability” and argued that Washington should refuse to entertain a taxpayer-funded bailout of AI firms while healthcare and food assistance remain inadequate for millions of Americans.

On scale, the comparison holds up. If policymakers decide that Nvidia, Microsoft, Amazon, OpenAI, and Anthropic are too central to be allowed to fail, any rescue package that meaningfully stabilizes them will be much larger in nominal dollars than TARP ever was. Even a limited backstop that covers a fraction of a severe drawdown would move real money.

On structure, the analogy is weaker. The 2008 crisis was about highly leveraged mortgage credit flowing through the banking system and into household balance sheets. AI investments are concentrated in the equity and capital spending budgets of a handful of mega-cap companies.

A crash would punish stockholders, trim retirement accounts that are heavily weighted toward tech, and likely freeze some chip and data center projects, but so far there is less evidence of a direct channel into household debt or bank solvency on the scale of subprime mortgages.

The real systemic risk sits somewhere in between. AI capital spending is enormous and heavily financed through corporate debt and equity markets. If that spending reverses quickly, it will hit suppliers, local economies that host data centers and chip fabs, and asset prices across major indices. The more federal policy leans into subsidizing this buildout, the more pressure there will be to stabilize it if valuations collapse.

Quiet subsidies now, bailouts later?

Another piece of AOC’s critique is that the groundwork for a bailout is already being laid. Watchdog groups have warned that the White House and OpenAI have discussed federal loan guarantees for chip infrastructure, while AI giants benefit from large government contracts and favorable regulatory treatment. That is different from an emergency rescue, but it does move public money closer to the core of the AI boom.

For readers thinking about these choices in household terms, the federal budget is not abstract. When trillions of dollars are at stake, you can see the tradeoffs in any simple budgeting sheet. A template like this Google Sheets budget spreadsheet makes it easy to imagine what happens when future public money is steered toward backstopping corporate losses instead of funding healthcare, food assistance, or other basic services.

Official documents on the 2008 crisis, including the Government Accountability Office’s lifetime cost review of TARP, show how quickly temporary support programs can grow in scope once markets seize up. The lesson is not that AI will crash in the same way. The lesson is that once the state is deeply entangled in an industry’s financing, the political pressure to protect that industry in a downturn becomes intense.

Who should carry the risk?

This is where the data ends and politics begins. AOC’s core argument is about who should carry the downside: the investors and executives who have driven AI valuations into the trillions, or taxpayers who are still struggling with healthcare costs and food insecurity. The bailout math suggests that, if Washington chooses the second option in a crisis, the price tag will not be marginal. It will be measured in trillions of dollars.

Whether that is acceptable is a policy choice. What the numbers make clear is that the choice exists, and that it will be harder to pretend otherwise as the AI boom grows. If lawmakers want to avoid replaying the politics of 2008 around a new set of companies, they have to decide now how much public risk they are willing to assume for the AI sector’s upside.