Donald Trump is floating a simple answer to a very real housing problem: stretch the standard 30-year mortgage to 50 years so monthly payments come down. On the surface it sounds like exactly what frustrated buyers want to hear in a year when three-quarters of voters tell pollsters the economy feels bad and housing costs are part of the squeeze.

A recent national survey found that 76 percent of voters now rate the economy as “fair” or “poor,” worse than the numbers at the end of Joe Biden’s term and even worse than this past summer. Voters are not just unhappy about abstract indicators. Large majorities say their grocery bills, utilities, housing, and healthcare costs have all gone up over the last year, and 60 percent say their own finances are only fair or poor.

That same poll delivered a sharp political warning for Trump: voters now blame his administration for current economic conditions by roughly a two-to-one margin, including a sizeable chunk of Republicans and most independents. Against that backdrop, a 50-year mortgage proposal is not just policy, it is a political bet that cheaper monthly payments can reset anger over affordability.

The problem is that mortgages are math, and the math here is brutal. Extending a loan from 30 to 50 years does lower the monthly bill, but it also means paying interest for an extra two decades.

And that’s where a simple Google Sheets mortgage calculator comes in handy. When you actually plug the numbers into a calculator or spreadsheet, the tradeoff looks less like relief and more like a very expensive peace treaty with your future self.

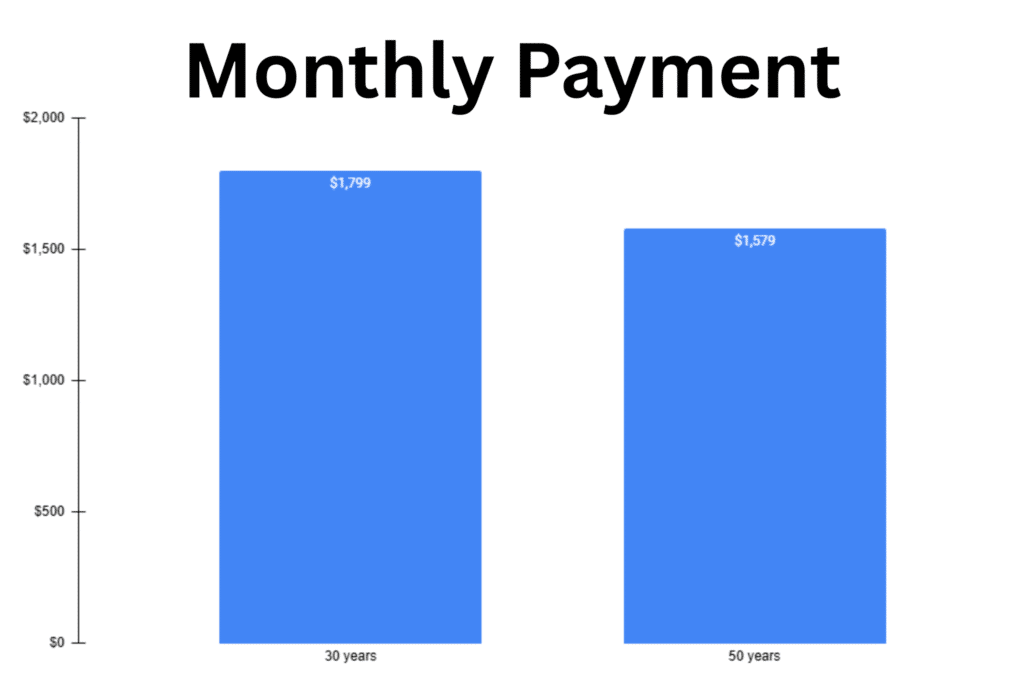

Take a straightforward example: a $375,000 home with 20 percent down, which leaves a $300,000 mortgage. At a 6 percent fixed rate, a 30-year loan on that house works out to a monthly principal-and-interest payment of roughly $1,799.

Stretch the same loan to 50 years at the same rate and the payment falls to about $1,579. On paper, that $220 a month discount looks attractive, especially for younger buyers or families who feel cornered by rent hikes.

| Loan term | Monthly payment | Total paid over life |

| 30 years | $1,799 | $647,515 |

| 50 years | $1,579 | $947,529 |

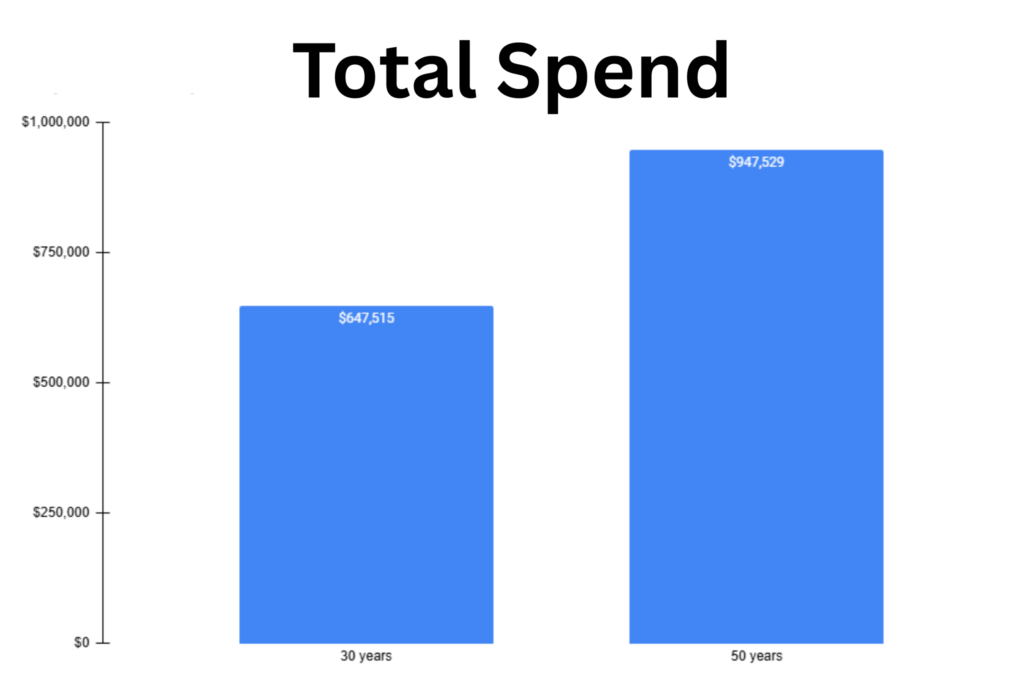

The long-term cost is where the 50-year option bites back. Over 30 years, that $300,000 loan at 6 percent generates about $348,000 in interest, for a total of roughly $648,000 paid over the life of the loan.

On a 50-year schedule, the total paid jumps to about $948,000, with roughly $648,000 of that as interest alone. You shave a couple hundred dollars off the monthly bill, but you end up paying almost $300,000 more in interest, or about 1.9 times the interest cost of the 30-year loan.

If you live in Excel or Google Sheets, this is a quick table to build. One column for loan amount, one for interest rate, one for term, and a pair of formulas that calculate monthly payment and total interest. From there you can duplicate the row, swap 30 for 50 in the term cell, and let the spreadsheet show you exactly how much future income you are handing over to get a smaller bill this month.

For readers who want to pay off credit cards or auto loans, a lower monthly payment could be a lifesaver. Paired with a debt snowball strategy, it could also be the difference between owning a home or renting forever.

But the length of the mortgage isn’t palatable to everyone. The total amount of interest paid over the life of the loan can be staggering.

The broader story behind Trump’s proposal is captured in the poll he is reacting to. According to a Fox News survey of 1,005 registered voters conducted November 14–17, 76 percent rate the economy negatively, and by a 62 to 32 margin they say Trump, not Biden, is more responsible for current conditions.

The Fox polling shows that voters are furious about prices and skeptical that the current White House has a plan to fix them. A 50-year mortgage might trim enough off the monthly bill to calm some nerves in the short run, but the math suggests it does so by quietly loading another generation with extra debt service. Before anyone writes that into law, it is worth opening a spreadsheet, typing in the numbers, and deciding whether a modest monthly discount is really worth buying the same house almost twice.