If you follow New York real estate on social media, you would think the city just elected a mayor determined to chase out every bank, hedge fund, and tech firm in Manhattan. If you follow the numbers, you get a very different picture.

Zohran Mamdani, a democratic socialist, is now the mayor–elect of New York City. His campaign focused on taxing the wealthy, freezing rents, and reshaping the city’s approach to housing. That has given overseas investors and some local landlords a convenient villain for every headline about vacancies or refinancing pain.

Yet at CNBC’s Delivering Alpha conference, two of the city’s most influential landlords told a story that does not match the panic. RXR CEO Scott Rechler and Rudin Management co–executive chairman Bill Rudin described a market where tenants are signing leases faster, flagship towers are filling, and leasing volumes are approaching pre–pandemic highs.

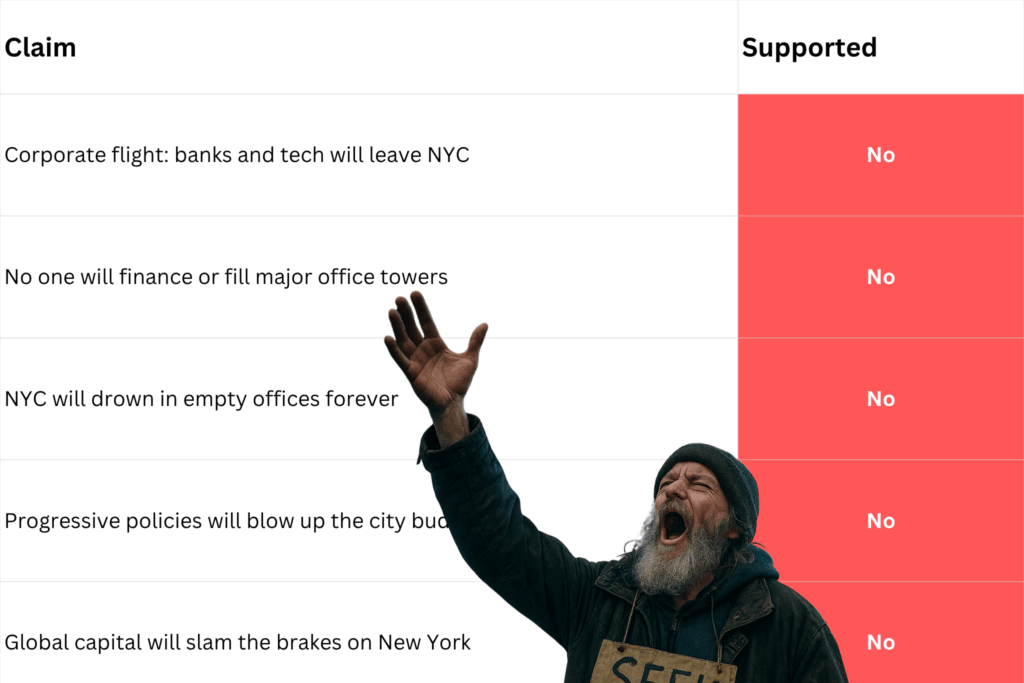

For an audience that cares about data, the useful exercise is not to pick which story to believe, but to put them side by side. One column for the rhetoric. One column for the actual market indicators.

The scoreboard: rhetoric vs reality

Here is a simple scoreboard for five themes that keep showing up in conversations about Mamdani and New York’s future. The rhetoric column is drawn from common talking points and investor fears. The market column is built from recent leasing and budget data across multiple sources, as we recently discussed in our breakdown of the data behind the NYC commercial real estate market.

| Rhetoric | Actual Data |

|---|---|

| “Banks and tech will leave for good. Midtown will hollow out under a socialist mayor.” | Colliers reports that 2024 Manhattan leasing reached 33.34M sq ft, the strongest in five years. Its October 2025 snapshot shows year to date demand already above that figure and on pace to pass 40M sq ft if trends hold. Commercial Observer and Savills note that Q1 2025 leasing was the best since late 2019 and that 2025 could match or beat 2019’s roughly 41.5M sq ft peak. |

| “No one will finance or fill major office towers in this environment.” | The Wall Street Journal highlights JPMorgan’s new three billion dollar headquarters at 270 Park Avenue, a 2.5M sq ft tower built for around 10,000 employees. Citadel, Blackstone, Deloitte and other firms have signed massive leases in top tier space. |

| “The city will be drowning in empty offices forever.” | The NYC Comptroller has identified about 15.2M gross sq ft of office space in completed, ongoing, or potential residential conversions since 2020. Colliers says nearly 5M sq ft of available office space was removed in 2024 alone for conversions. |

| “Progressive policies will blow up the budget and starve services.” | New York’s budget was roughly 60B dollars under Michael Bloomberg. Bloomberg News reports that the latest Adams budget deal is just under 116B dollars. Revenue growth has been uneven, and there are structural risks, but there has been no collapse in the tax base that funds schools and transit. |

| “Global capital will slam the brakes on New York.” | Rechler says Mamdani is now a top topic on his overseas roadshow, and there is visible caution in multifamily. Yet the actual leasing and conversion numbers show capital reallocating within the city, not fleeing it. High quality office, logistics, and residential projects continue to attract domestic and international investors who are more worried about asset quality and interest rates than one mayor’s rhetoric. |

Each of these rows could be a worksheet in a larger model. Annual leasing and vacancy data can sit in one tab, conversion projects in another, fiscal trends in a third. If you want to extend this scoreboard, you can download raw figures from brokerage reports and city budgets and build your own traffic light system for corporate flight, supply, and fiscal health.

Templates like an investment tracking spreadsheet are a useful starting point for that kind of monitoring. You can adapt them to track leasing volumes by submarket, keep a running tally of conversions, and compare your expectations for rent growth against what actually shows up in quarterly reports.

What makes the leasing numbers so important

The reason this scoreboard matters is not that it proves Mamdani is good for business or harmless to it. It is that the leasing data are slow moving and cumulative. Tenants rarely take hundreds of thousands of square feet on a whim. They sign after long internal debates about headcount, hybrid patterns, and the quality of their workforce.

When leasing volumes rise above a 25 year average, as Colliers and CRE Daily note for 2024 and 2025, that signals a broad based bet on New York’s long term role in finance, media, and tech. When conversions pull millions of square feet out of the obsolete end of the market, that tightens supply at the same time. That combination of demand and shrinking stock is what eventually pushes effective rents up again, even if headline vacancies look stubborn for a while.

For landlords, the practical takeaway is that the cycle is shifting from “how do I keep the lights on at any rent” to “how do I position my building to compete as Class A tenants run out of options.” For tenants, it is a warning that the window for generous concessions in the best buildings may close faster than the political noise would suggest.

If you want to stress test those ideas with your own numbers, a simple workbook that pairs a leasing time series with a rent calculator can help. A rent calculator spreadsheet and Google Sheets budget template give you a way to plug in current rent levels, expected escalations, and vacancy assumptions and see how quickly a “doom loop” narrative breaks down once you adjust for conversions and outsize leasing in Class A space.

The political risk that does not show up in quarterly charts

None of this means that Mamdani’s platform is irrelevant. Rechler is blunt that when he speaks to overseas capital, concerns about rent freezes, tax hikes, and rhetoric about public control of housing dominate the conversation. There are real risks that policy missteps could slow down new multifamily projects or push some marginal investors to other markets.

The reality, though, is that most of the levers that scare investors are not controlled by the mayor alone. A Bloomberg News issue guide on the 2025 mayoral race makes it clear that state legislators decide much of the tax structure and rent regulation framework, while local zoning changes must survive the City Council, community boards, and in some cases the courts. Bloomberg’s candidate breakdown is a reminder that New York’s political system is designed to be friction heavy.

That friction cuts both ways. It limits how far a left wing mayor can push on taxation and ownership, but it also slows down reforms that could add a lot more housing. For younger voters who backed Mamdani because rent takes most of their paycheck, what matters is not the leasing chart but the rent to income ratio. So far, that ratio has moved in the wrong direction.

A serious risk model for New York would include both sides of that story: a tab for office leasing and conversions and another for housing affordability. That second tab might look more alarming. Median rents have outpaced wages for years, and even aggressive conversion policy will not fix that overnight.

The bottom line for data focused readers

For now, the scoreboard is tilted in favor of the market, not the panic. Leasing volumes are rising, conversions are tightening supply, the budget has not blown up, and flagship towers are filling. Investor anxiety about a “socialist mayor” is real, especially in multifamily, but it has not yet shown up in the core office data.

It is entirely possible that policy mistakes, another rate shock, or a deeper recession could flip that story. The point of a scoreboard like this is not to declare victory, but to keep recalculating as the data change.

For an audience that lives in spreadsheets, the healthiest habit is to treat every narrative about New York, good or bad, as a hypothesis and test it against the next Colliers report, the next Comptroller note, and the city’s next budget. In other words, the future of New York’s office market is written, quarter by quarter, in the cells of a leasing spreadsheet.