Medicare Part B premiums will rise 9.7% to $202.90 monthly in 2026, potentially offsetting some of the 2.8% Social Security cost-of-living increase.

The Centers for Medicare and Medicaid Services announced Friday that standard Medicare Part B premiums will climb to $202.90 per month starting in 2026, marking a $17.90 increase from the current $185 monthly rate. The 9.7% jump represents the second-largest dollar increase on record, trailing only the $21.60 spike that occurred in 2022.

For the roughly 60 million Americans enrolled in Part B, the news arrives alongside a modest 2.8% cost-of-living adjustment to Social Security benefits, expected to add about $56 monthly on average to retirement checks. This comes shortly after the longest government shutdown in the nation’s history.

The timing creates a squeeze for retirees. Since Medicare Part B premiums are typically deducted directly from Social Security payments, the substantial premium increase will consume a significant portion of the annual benefit raise. The annual deductible for Part B will also rise 10% to $283, compounding the financial pressure on seniors already managing fixed incomes.

As always, we looked at the data behind this trending story. The facts are announced from the government, and interested parties can review them at CMS.gov. The increases stem from projected price changes and utilization patterns consistent with historical healthcare trends, according to CMS documentation.

However, not all beneficiaries face identical premiums. Approximately 8% of Part B enrollees with higher incomes pay income-related adjustment amounts added to their standard premiums. We sorted the data by 2025 premiums for Part B by adjusted gross income, then laid out the expected premiums for the upcoming year.

| 2025 income bracket (joint MAGI) | 2026 income bracket (joint MAGI) | 2025 monthly Part B premium | 2026 monthly Part B premium | Percent change |

|---|---|---|---|---|

| ≤ $212,000 | ≤ $218,000 | $185.00 | $202.90 | +9.68% |

| to $266,000 | to $274,000 | $259.00 | $284.10 | +9.69% |

| to $334,000 | to $342,000 | $370.00 | $405.80 | +9.68% |

| to $400,000 | to $410,000 | $480.90 | $527.50 | +9.69% |

| to $750,000 | to $750,000 | $591.90 | $649.20 | +9.68% |

| ≥ $750,000 | ≥ $750,000 | $628.90 | $689.90 | +9.7% |

Those earning less than $109,000 individually or $218,000 as a married couple filing jointly will pay the standard $202.90 rate. A hold harmless provision prevents Social Security benefits from declining due to Part B premium hikes alone, though other deductions for Medicare Advantage or prescription drug coverage may still reduce monthly payments.

For retirees, and those planning for retirement, already stretched thin by healthcare costs, the 2026 premium increase underscores the persistent challenge of affording medical care on fixed incomes. Those experiencing significant income changes or qualifying life events can report adjustments to the Social Security Administration, potentially lowering their income-related premiums.

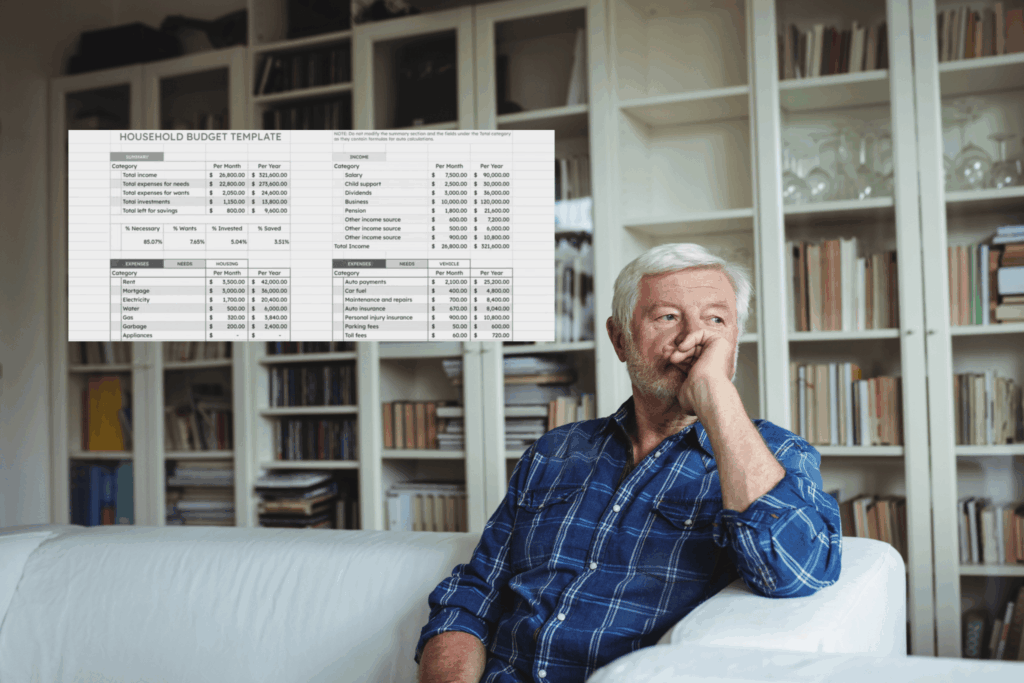

The pattern suggests that healthcare inflation continues outpacing the modest adjustments Social Security provides, leaving many seniors to absorb rising medical expenses through reduced discretionary spending or difficult choices about their coverage. Those looking to reduce spending can use a Google Sheets budget spreadsheet to reign in costs, and conservative planners may want to include anticipatory increases for deductible costs each year moving forward.