The Federal Reserve today cut its benchmark policy rate by a modest 0.25%. This move signals a pivot in monetary policy, but internal discord was immediate and vocal. The widely anticipated reduction followed months of speculation. The vote, however, was far from unanimous.

The fractional adjustment lowers the target range for the federal funds rate to 3-1/2 to 3-3/4 percent. This decision marks a critical juncture, navigating a landscape still scarred by inflation fears and economic uncertainty. Historically, such delicate maneuvering often precedes significant market shifts.

Not everyone on the Federal Open Market Committee (FOMC) was convinced. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid dissented, standing firm against the majority.

Their argument was clear: the policy rate should remain unchanged. This stance suggests they view the current economic trajectory as robust enough to withstand higher rates, or still vulnerable to inflationary pressures, making any cut premature.

Such hawkish stances echo past periods where the Fed was criticized for loosening policy too quickly, reigniting price surges. For diligent asset trackers, understanding these underlying currents is crucial, often best managed with robust investment tracking spreadsheets.

On the opposite end, Stephen Miran called for a more aggressive cut. Miran’s dissent for a larger reduction implies a belief that the economy requires a more substantial jolt to stimulate growth or combat recessionary forces. His perspective aligns with those arguing the Fed has been too slow to respond, potentially stifling recovery.

This split vote underscores deep divisions within the Fed regarding the U.S. economy’s true health and direction. To some, a mere 0.25% cut is a concession, not a decisive policy shift. And the FRED has an interactive chart if you want to review previous Federal Funds rates.

Historically, small, incremental cuts can signal institutional indecision or a mere test of the waters. Is this a genuine turning point, or a hesitant step designed to appease markets without committing fully?

The Fed’s wait-and-see strategy has a track record of mixed results, sometimes leading to larger, more disruptive interventions. More coverage, including the full Fed statement, is available at Reuters.

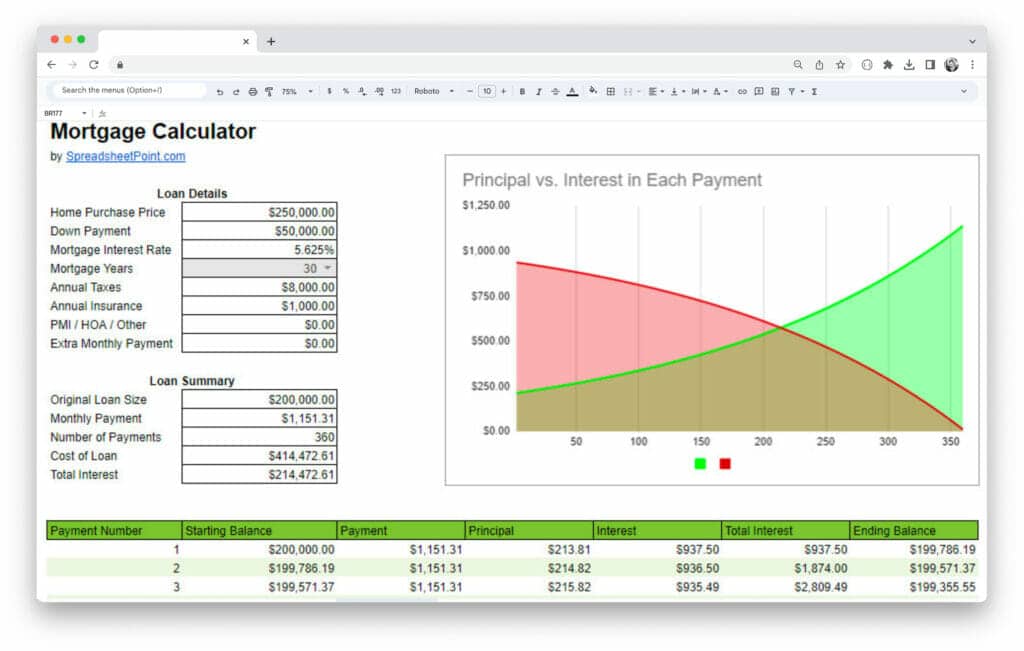

For the average household, this fractional shift might barely register on a monthly budget. At least if you look at it based on everyday expenses like those you’d see in a Google Sheets budget template. But for those burdened by variable-rate debt, even a modest cut offers a glimmer of relief, potentially impacting their loan amortization schedule on home purchases.

Using an amortization calculator, potential homebuyers (and those looking to refinance) can see that a 0.25% lower rate could save tens of thousands of dollars over the life of a loan. On a $600k home, a homeowner could save $25k in interest payments over 30 years.

Is this enough to truly move the needle, or merely a symbolic gesture in a complex economic game? The market, as always, will soon provide its own, often brutal, answer.