Key Takeaways

- The Sticker Shock: Drugmakers are raising list prices on ~350 medications starting today, Jan 1, 2026.

- The Guardrail: Medicare Part D now caps annual out-of-pocket spending at $2,100, but this doesn’t fix cash flow issues in January.

- The Risk: Seniors who don’t hit the cap, or take drugs covered by Part B, may still face rising costs without protection.

Drugmakers are raising list prices on at least 350 medications in 2026. Medicare Part D caps out-of-pocket drug spending at $2,100 this year. So do the hikes still matter for seniors?

Yes, but the impact is less about the annual total and more about what happens at the pharmacy counter in the first months of the year.

Today is the day when many price changes hit, and it is also when deductibles and plan cost-sharing reset. That is why “only a few percent” can still feel like a surprise, especially if you pay coinsurance.

Most people fall into one of three lanes: you hit the cap, you never hit the cap, or your medication spending is outside Part D’s protection. The same list price hike lands very differently in each lane.

A 10-minute reality check

- List your prescriptions and note whether each is covered under Part D or billed under Part B.

- For your Part D drugs, check whether you pay a flat copay or a percentage (coinsurance).

- Look at last year’s total out-of-pocket spending for Part D drugs, and decide if you are likely to reach $2,100 in 2026.

- If you will reach the cap, focus on timing and cash flow in January through March. If you will not, focus on tier changes, restrictions, and slow drip increases across the year.

According to Reuters, manufacturers plan price increases on at least 350 branded drugs, with a median list price increase of about 4%. Reuters also notes these list increases do not reflect rebates and discounts negotiated behind the scenes, which is one reason consumers struggle to connect a headline to what they pay at the counter.

Here is what the Part D cap does. In 2026, Medicare caps out-of-pocket costs for covered Part D drugs at $2,100 for the year. Once you reach the cap, cost sharing for covered Part D drugs drops to $0 for the rest of the calendar year.

Here is what the cap does not do. It does not cap your monthly plan premium. It does not apply to drugs your plan does not cover. It does not apply to many drugs billed under Medicare Part B, including some infused or injected drugs given in clinical settings. In short, it is a major guardrail, not a universal ceiling on medication-related costs.

The three lanes, and what to watch on your receipt

| Lane | How a list hike can show up | What to check |

|---|---|---|

| You hit the $2,100 cap | Earlier spending, faster march to $0 later | January coinsurance, deductible resets, month you reach the cap |

| You never hit the cap | Small changes all year, often via plan design | Tier placement, prior authorization, step therapy, copay changes |

| Outside Part D protection | Costs can rise without the Part D cap helping | Part B coinsurance, infusion center billing, coverage rules |

Lane 1: You hit the cap

If your medication is expensive enough, you may reach $2,100 quickly. A list price increase can change the timing, not the maximum. That timing still matters because it changes cash flow; you might spend more up front, even if you pay $0 later in the year.

Lane 2: You never hit the cap

This is the quieter story. If you take a few maintenance medications with modest cost sharing, the cap may never activate. In that lane, the real risk is plan behavior: a drug moves tiers, coinsurance applies where a copay used to, or utilization rules tighten.

Lane 3: You are outside Part D’s protection

If a drug is not covered by your plan, or it is billed under Part B, the Part D cap does not help. For patients receiving drugs in an infusion center, out-of-pocket math can look nothing like pharmacy counter math.

Pro Tip: Smooth out the “January Shock”

There is a newer option called the Medicare Prescription Payment Plan. It allows you to spread out-of-pocket Part D costs across the year instead of paying them all at once. It is a budgeting tool, not a discount, but it can be a lifesaver for people who would otherwise face a massive bill at the counter in January.

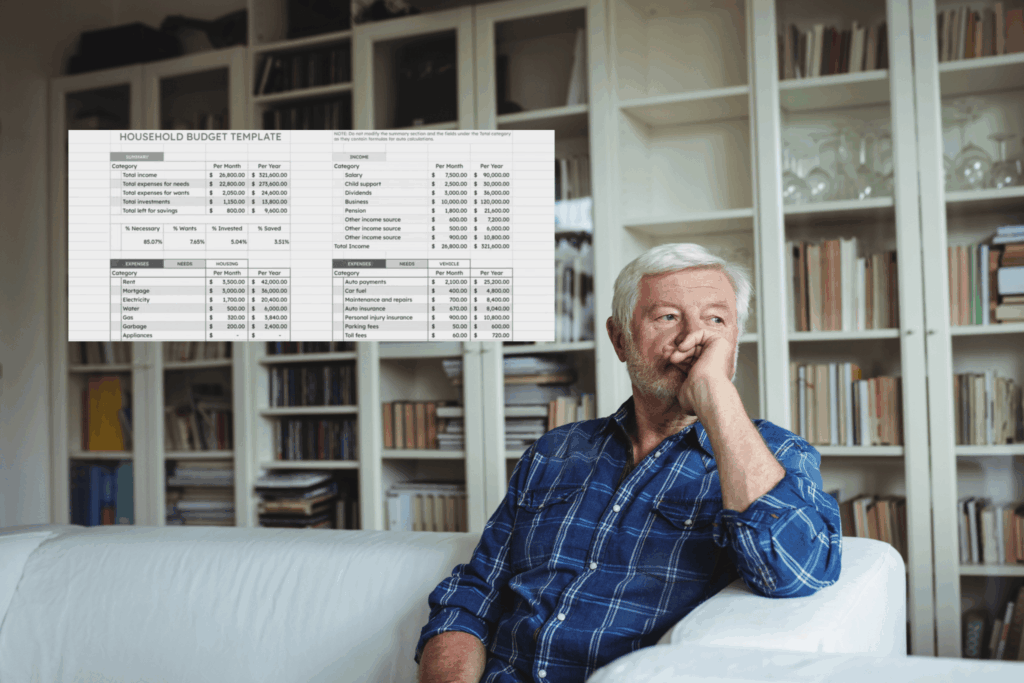

If you want to evaluate what the 2026 hikes mean for your household, you can do it with a simple spreadsheet, even without perfect data.

Step 1: Decide your lane using last year’s totals.

If you were nowhere near $2,000 in 2025, the 2026 cap is not the headline for you. If you were well above it, the cap matters, but timing matters too.

Step 2: Track what you actually pay.

Record date filled, medication, tier, and your out-of-pocket cost each time. A simple medication log is enough to spot when your plan rules or cost-sharing change.

Step 3: Run two scenarios.

- Scenario A: Assumes cost sharing stays the same.

- Scenario B: Assumes your plan changes something, like a tier shift or a coinsurance change.

This is where a household view helps, because a few higher months can force tradeoffs elsewhere. A clean starting point is a Google Sheets budget template. If you want something lighter, use an expense tracker spreadsheet.

For retirees, keep the broader Medicare picture in view. Premiums and deductibles can rise even when out-of-pocket drug exposure is capped. For 2026 planning context, see Medicare Part B premium increase in 2026.

The Bottom Line

The $2,100 cap makes the worst cases less financially catastrophic for people on covered high-cost drugs. It does not eliminate pressure from list price increases, because many consumers never reach the cap, feel the impact in January cash flow, or pay for drugs outside Part D’s protection.

If you want one question to carry into 2026, make it this: Which lane am I in, and what does that mean for my first refill of the year?