In this market, you do not need to say much more than “AI stock” before people start thinking about Palantir and Nvidia. The former has worked hard to shift its image from a government data contractor to an AI platform. The latter sells the GPUs that power most of today’s large language models.

Both have seen their valuations explode as investors try to buy a piece of the AI future. Michael Burry looks at the same landscape and comes away with a very different conclusion.

He’s the one who pushed for the creation of the credit default swap on subprime mortgages before the 2008 crisis, so he could get paid when homeowners stopped paying their loans. He made his name by treating balance sheets and legal terms as puzzle pieces, then constructing a trade that profited when the housing system finally cracked. When he compares the AI boom to the dot-com era, he is thinking about capital expenditure cycles, penetration rates, and how long it really takes for a transformative technology to show up in earnings.

He tells Lewis that the AI bubble feels similar to 2000 in one important way. Capital expenditure is already at levels that match previous peaks, yet everyone talks as if this is still the early innings.

That combination, high spending and high expectations, can support extreme valuations for a while. It rarely protects investors when the cycle turns.

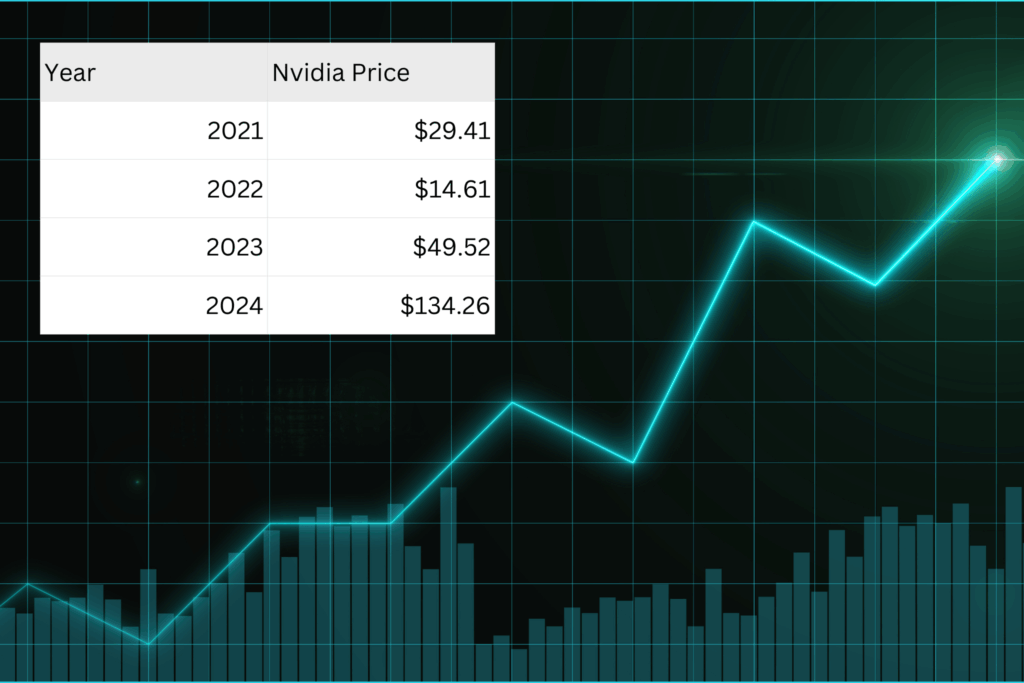

If you pull the simple year-end numbers on Nvidia, you can see the shape of that boom in four data points. The stock finished 2021 at about $29.41 on a split-adjusted basis, dropped to roughly $14.61 at the end of 2022, then rocketed to $49.52 at the close of 2023 and $134.26 at the end of 2024. Even after the company’s stock split, that is a move from the mid-teens to well over $100 in just two years.

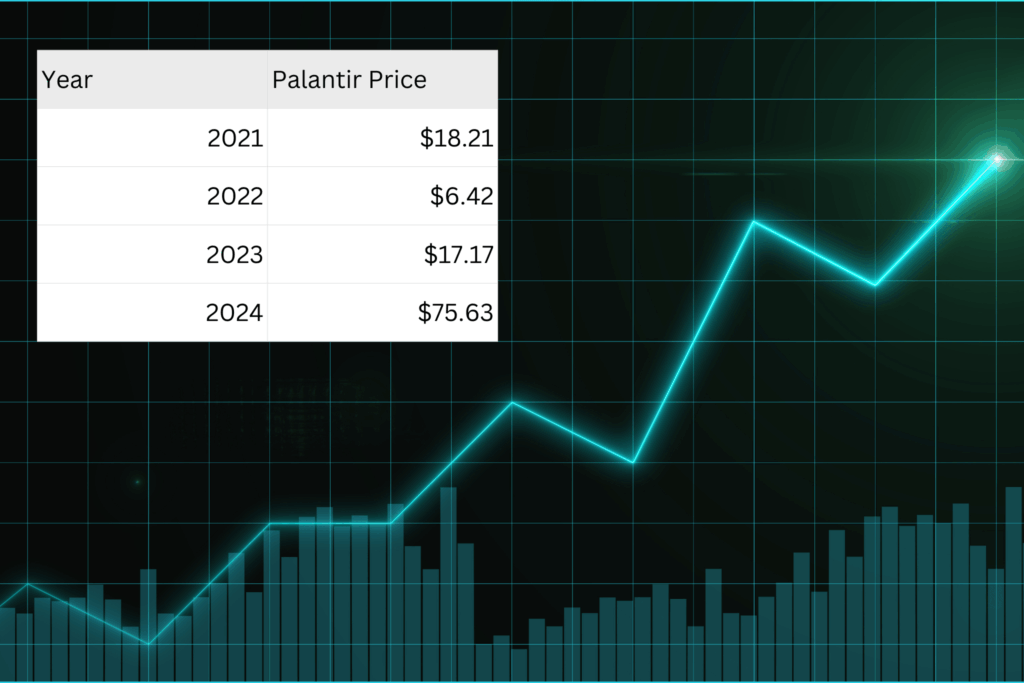

Palantir followed a different path to the same kind of frenzy. Its share price slid from about $18.21 at the end of 2021 to just $6.42 at the end of 2022, then nearly tripled to $17.17 by the close of 2023 before blasting up to $75.63 at the end of 2024. That last jump made it one of the star performers among new S&P 500 additions in 2024, with some trackers putting its annual gain in the mid-300 percent range.

Those tables tell you where the real lift-off happened. Nvidia’s story is not a straight line up. The stock was cut in half between 2021 and 2022, then delivered back-to-back years of triple-digit gains as AI data center spending went vertical and its market cap surged past three trillion dollars. Palantir was left for dead in 2022, then staged a speculative comeback that turned a single year of AI enthusiasm into a fourfold increase from 2023 to 2024.

For Burry, this is exactly what “luck” looks like in markets. Nvidia happens to sell the chips that became the standard for training large language models at the same time hyperscalers and startups were willing to sign eye-watering infrastructure commitments.

Palantir happened to be sitting in the right narrative slot when investors went hunting for “pure play” AI software bets. You can walk backward from those price charts to see the narrative waves that carried them.

Palantir is the first case study. Burry’s critique focuses on the basic economics of the business. He argues that its software has historically been very expensive and complicated to install. The company’s reputation is built on winning government contracts and navigating that world effectively. That can be a defensible niche, but it is not the same thing as a frictionless AI platform that enterprises can spin up like a cloud service.

He also zeroes in on stock-based compensation. His suggestion is simple. Look at how much stock a company is buying back and subtract it from cash flow. In Palantir’s case, he says, once you adjust for the shares it effectively hands back to employees, the business does not generate as much real money as the AI narrative implies. We dug into the same accounting concerns in my earlier coverage of how Burry criticizes tech’s AI earnings manipulation.

Nvidia is a different type of story, but Burry’s skepticism rhymes. The company has undeniable pricing power today. Its GPUs are scarce, and demand from hyperscalers and AI startups is intense. That does not guarantee that current margins and multiples are permanent. As more players ramp up their own chip efforts and as customers push back on costs, the current level of profitability could prove to be a high-water mark rather than a baseline.

Even Google’s own CEO, Sundar Pichai, has started to talk about “irrationality” in the AI boom and warned that no company, including Alphabet, would be immune from an AI market crash, a worry we unpacked in our breakdown of why Google’s CEO admits the AI boom looks irrational, even for Alphabet.

That is part of why Burry has used long-dated, out-of-the-money puts tied to AI-heavy names, including positions that appeared in his 13F filings. Those filings triggered a wave of coverage portraying them as gigantic all-in shorts. On the podcast, he explains that this is another case where surface-level readings mislead people. The notional exposure looks huge, but the actual premium he pays can be tiny relative to the headline figure, so the risk profile is very different from simply shorting the stock.

Burry has also been blunt about other speculative manias. On “Against the Rules,” he dismisses the idea of Bitcoin at $100,000 as “ridiculous” and argues that the asset is not worth anything in fundamental terms. That stance lines up uncomfortably well with the latest crypto rout, where Bitcoin dropped from the $120,000s to the $80,000s in hours.

If you want to hear Burry lay out his critique in his own voice, including why he thinks Palantir and Nvidia have been so lucky, you can. It’s worth a listen, where you can here his conversation with Michael Lewis on the Against the Rules podcast.