New economic data shows U.S. manufacturing continues to struggle with job losses and rising prices, sparking heated discussion about the causes and consequences.

The U.S. manufacturing sector is experiencing its ninth consecutive month of economic contraction, according to recent reports from the ISM Manufacturing PMI and S&P Global. The data reveals a troubling picture: blue-collar employment is declining, prices continue to climb, and new orders are falling.

These figures have reignited a broader conversation about economic policy and its impact on working Americans, with observers pointing to tariff policies as a key factor in the sector’s deterioration. The truth is that manufacturing employment numbers looked grim even before the tariff announcements earlier this year.

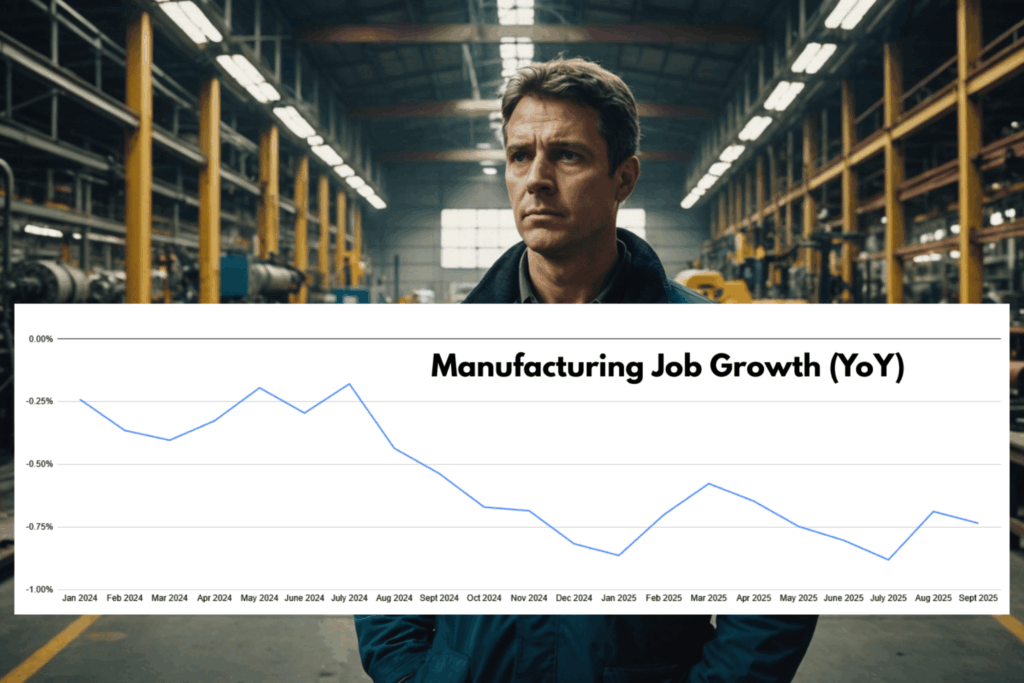

Numbers from the Bureau of Labor Statistics add more detail to that story. BLS data on manufacturing employment show negative month-over-month job growth in every single month from January 2024 through September 2025.

| Manufacturing Job Growth | |

| Jan 2024 | -0.24% |

| Feb 2024 | -0.36% |

| Mar 2024 | -0.40% |

| Apr 2024 | -0.33% |

| May 2024 | -0.19% |

| June 2024 | -0.30% |

| July 2024 | -0.18% |

| Aug 2024 | -0.44% |

| Sept 2024 | -0.54% |

| Oct 2024 | -0.67% |

| Nov 2024 | -0.68% |

| Dec 2024 | -0.82% |

| Jan 2025 | -0.86% |

| Feb 2025 | -0.70% |

| Mar 2025 | -0.58% |

| Apr 2025 | -0.65% |

| May 2025 | -0.75% |

| June 2025 | -0.80% |

| July 2025 | -0.88% |

| Aug 2025 | -0.69% |

| Sept 2025 | -0.73% |

The timing of these reports has intensified political debate. While some analysts attribute the manufacturing slowdown to specific policy decisions, others point to broader structural challenges facing the sector, including automation and global supply chain dynamics.

The contrast between campaign promises of economic revival and current economic indicators has become a focal point for commentary across the country. Recent contractions in cryptocurrency markets only add to the economic stress for some young workers.

For workers and managers trying to understand what these percentages mean on the ground, simple spreadsheets have become a useful way to turn headlines into trackable data. Some are logging plant-level hiring freezes, overtime cuts, and layoffs alongside official BLS series, then turning those lists into live dashboards that track how conditions change month by month in their own regions.

That kind of tracking is easier when you start from a ready-made template rather than a blank grid. A manufacturing manager watching headcount can adapt a dedicated job tracker spreadsheet or build a broader operations dashboard with the Google Sheets dashboard template, then plug in basic forecasting using guides.

As these economic headwinds persist, the debate over responsibility and solutions continues to shape public discourse. The manufacturing sector’s struggles continue to reflect deeper questions about economic fairness, long-term opportunity, and how working Americans can use data to make sense of a shifting labor market.