Bitcoin plunged nearly $4,000 in hours as investors fled risky assets amid macroeconomic uncertainty and a striking absence of bargain hunters.

In early December trading, Bitcoin experienced a jarring wake-up call. After climbing above $126,000 just weeks earlier, the world’s largest cryptocurrency tumbled below $86,000 in a matter of hours, shedding roughly 6 percent of its value.

The selloff, so far, has been swift and unforgiving. Ethereum dropped more than 7 percent to around $2,800, while Solana, Cardano, and other major tokens followed suit. Within 60 minutes, roughly $400 million in leveraged long positions were liquidated, according to market observers, as panic selling accelerated across the sector.

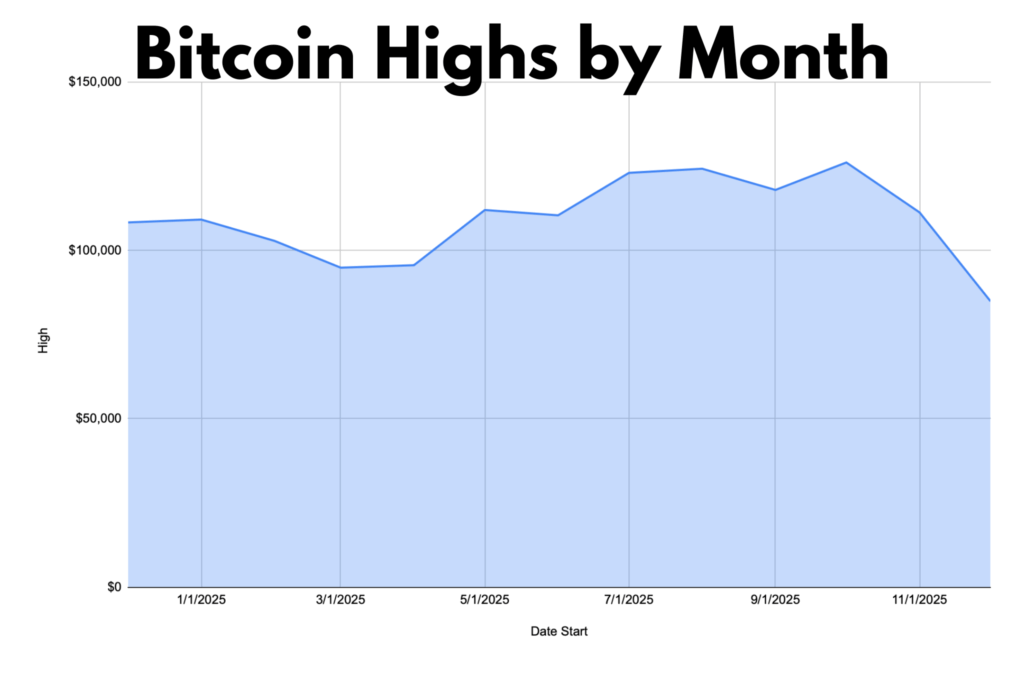

To put that move in context, here are Bitcoin’s monthly highs from January through November 2025.

| Month (2025) | Bitcoin monthly high |

|---|---|

| January | $109,079 |

| February | $102,760 |

| March | $94,808 |

| April | $95,538 |

| May | $111,924 |

| June | $110,347 |

| July | $122,946 |

| August | $124,171 |

| September | $117,879 |

| October | $126,025 |

| November | $111,197 |

What made this decline particularly striking was the absence of the usual rescue buyers. Normally when Bitcoin dips sharply, a fresh wave of investors swoops in seeking bargains. This time, that safety net failed to materialize.

Those who track their crypto investments with a spreadsheet may see columns of red today. And some in the online investing community have pointed to meager inflows into Bitcoin exchange-traded funds and a notable lack of dip buyers as the primary culprit. Without that traditional cushion, leveraged positions unwound rapidly, creating a cascade of forced selling that pushed prices lower still.

The broader context matters too: macroeconomic uncertainty is weighing on all risk assets. With the Federal Reserve signaling fewer interest-rate cuts ahead and inflation remaining stubborn, investors are retreating from speculative bets across the board. So update your Excel stock trackers. There is so much more news coming this month.

The broader community response reflected a mix of frustration and philosophical questioning. Commenters highlighted the tension between Bitcoin’s aspirations as a currency and its extreme volatility. Skepticism has centered on whether cryptocurrencies are truly insulated from economic turbulence or simply ultra-volatile risk assets masquerading as something more.

Some analysts now point to the $80,000 to $85,000 range as critical support. If that floor holds, Bitcoin could stabilize or even rebound in coming weeks. If it breaks, a deeper decline may be underway.

For those who bought near the October peak, profitability remains a distant prospect. Yet some observers see opportunity in the chaos. Disciplined investors with a long-term outlook might view this as a discount window, though anyone treating Bitcoin as a safe haven is likely in for disappointment.

The episode underscores a fundamental truth about cryptocurrency. It remains tightly coupled to broader market sentiment and macroeconomic conditions. Volatility that feels thrilling on the way up becomes brutal on the way down.

Whether this marks a temporary correction or the start of a more prolonged downturn depends largely on signals from central banks and the trajectory of global economic data. For now, the crypto world is watching and waiting.