At first glance, tying the fate of Las Vegas housing to the performance of the NASDAQ might seem like a stretch. One is a regional housing market grounded in local employment and migration trends.

The other is a high-octane index of the world’s biggest tech companies. But a look at the numbers over the past decade reveals a fascinating and surprisingly consistent pattern: When tech stocks surge in Q1, Las Vegas home prices tend to stagnate.

This isn’t some fleeting coincidence. In fact, the data shows one of the strongest inverse correlations of any major city we analyzed. The trendline isn’t just suggestive. It’s sharp.

Over and over, years with big Q1 NASDAQ gains have been followed by flat or negative growth in Vegas housing during the same quarter. And the contrast is often dramatic.

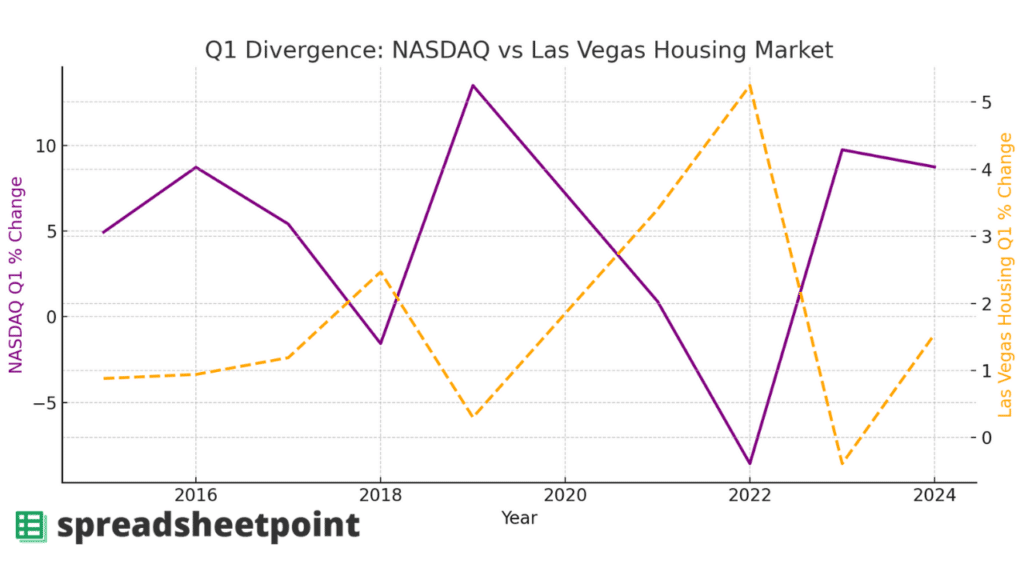

The chart below tells the story in vivid color and leaves little room for data misinterpretation. While the NASDAQ (purple line) shows robust growth in Q1 during several years, especially 2017, 2019, and 2021, the Las Vegas housing market (orange dashed line) often heads in the other direction. In 2018 and 2022, the divergence is particularly clear: When the NASDAQ dipped or stayed flat, housing prices in Las Vegas jumped. And in 2021, NASDAQ climbed more than 10 percent, while Vegas housing barely budged.

Why does this happen? One likely explanation is shifting investor focus. Las Vegas has long attracted speculative real estate activity, but when tech stocks are booming, that capital may be redirected to Wall Street. The NASDAQ’s performance often reflects broader investor sentiment and risk appetite. When tech is hot, real estate becomes less of a priority, particularly in a city like Las Vegas, where price movements can be sharp but unpredictable.

The inverse trend also holds up when tech cools off. In 2022, the NASDAQ fell in Q1, while Las Vegas housing recorded its biggest Q1 gain of the decade. With a calculated correlation coefficient of -0.91 between NASDAQ Q1 gains and Las Vegas Q1 home price changes, the relationship is stronger than what we’ve seen in any other major market.

If that trend continues, 2024 could bring more of the same. Tech stocks rose sharply again in Q1, with the NASDAQ up over 12 percent by the end of March. Historically, that kind of performance coincided with housing slowdowns in Las Vegas. So while national headlines may focus on Silicon Valley’s rally, those watching the housing market in southern Nevada may want to temper their expectations for spring growth.

So there’s a silver lining to plummeting NASDAQ prices in Q1 of 2025. If previous trends hold true this year, it could be a positive sign for growing home prices in Las Vegas.

Of course, no market runs on a single signal. Mortgage rates, inventory levels, and local economic factors all matter. Still, for buyers, sellers, and investors hoping to get an edge, this inverse NASDAQ-Vegas relationship offers a compelling and consistent clue.

Las Vegas has always been a bit of a gamble. But if the last ten years are any indication, when Wall Street is winning big, it might be time to play it safe on the Strip.