Scientists discovered the world’s largest lithium deposit under McDermitt caldera, enough to power global batteries for decades. We evaluated how much it could actually be worth.

Beneath the Nevada-Oregon border, hidden inside an ancient volcanic crater called McDermitt caldera, lies an enormous cache of lithium-rich clay. Researchers at Lithium Americas Corporation estimate the deposit holds between 20 and 40 million metric tons of lithium, valued at roughly $1.5 trillion at current market prices.

The discovery represents what may be the single largest concentration of this critical mineral ever identified. For a world racing to electrify transportation and store renewable energy, the find feels almost too good to be true.

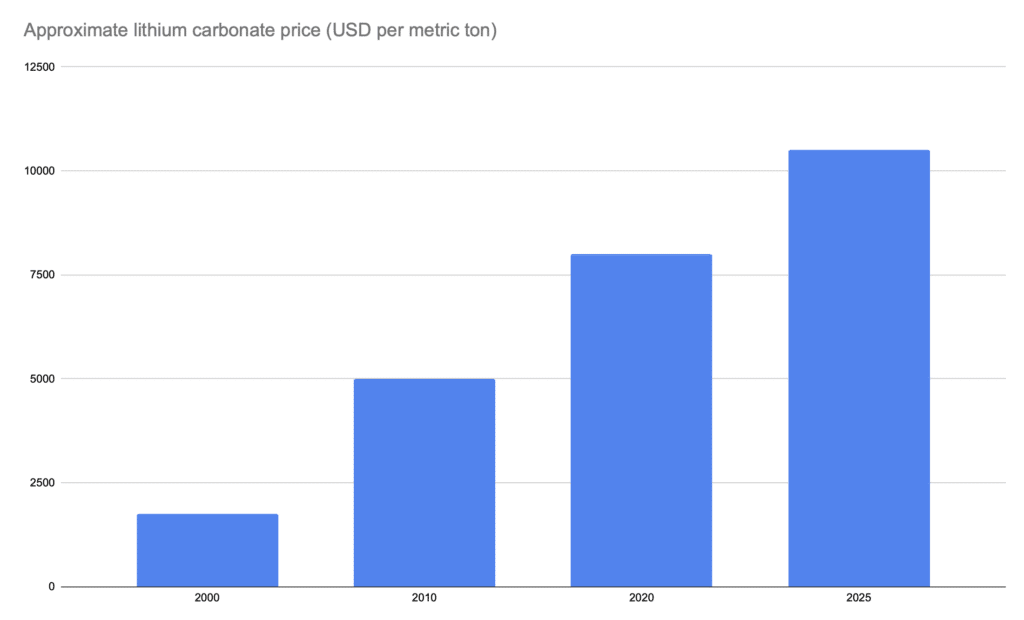

To understand why a single deposit can be worth that much, you have to step back and look at how lithium prices have changed in this century. Around 2000, lithium carbonate was a niche industrial chemical, and prices reflected that.

A historical review of the industry notes that lithium carbonate prices fell to about $1,760 per metric ton in 2000 during a period of oversupply from Chile relative to global demand. A United Nations presentation from 2010 describes how, over the following decade, demand for lithium grew 7 to 8 percent per year and pushed prices from that $1,760 level into the low-to mid-$5,000-per-ton range by about 2010, even though different data series give slightly different exact numbers.

By 2020, lithium had become the backbone of the battery economy. U.S. Geological Survey data put the annual average U.S. lithium carbonate price for large fixed contracts at about $8,000 per metric ton that year.

Then came the EV boom and the 2021–2022 price spike, followed by a steep correction. Analysts at S&P Global Commodity Insights now expect the annual average battery grade lithium carbonate price to settle near roughly $10,500 per metric ton in 2025, down sharply from the 2022 peak but still far above early-2000s levels.

All of these numbers are estimates and depend on whether you track Chinese spot prices, U.S. contract prices, or global battery grade benchmarks, but the direction is clear. Lithium has moved from a cheap raw material to a strategic mineral.

If you want to dig into the numbers yourself, tools like the GOOGLEFINANCE function in Google Sheets make it easy to pull time series data into a spreadsheet so you can chart price swings and compare them with EV sales or battery deployment. You can also plug lithium price assumptions into an investment tracking spreadsheet template or even a portfolio-style dashboard if you want to stress test different price paths over the next decade.

The geology behind the McDermitt deposit reads like a masterclass in how Earth creates valuable resources. About 16 million years ago, a massive volcanic eruption emptied the magma chamber beneath the caldera, leaving behind thick sheets of ash that cooled into rock.

A long-lived lake then collected volcanic sediments, and over millions of years, hot mineral-rich fluids rising from below transformed those lake muds into clay minerals that locked in extraordinary concentrations of lithium. The richest layer, called illite, sits close to the surface and contains roughly double the lithium of typical clay deposits, making large-scale pit mining technically feasible.

Yet the discovery has sparked sharp debate among observers and commenters online. While some celebrate the potential to reduce dependence on distant lithium sources and lower the environmental footprint of mining through a single, shallow operation, others voice deep skepticism.

The community has raised concerns about water depletion, dust pollution, habitat fragmentation, and the cultural significance of the landscape to local tribes and ranching communities. Commenters have expressed cynicism about corporate promises to mine responsibly, noting that extraction companies have a mixed track record of respecting indigenous land rights and environmental commitments.

The technical challenge of processing clay-hosted lithium adds another layer of complexity. Unlike salty brines that yield lithium more easily, clay deposits require grinding, chemical leaching, and careful recovery methods that demand significant water and energy.

Engineers must balance the promise of abundant supply against the reality of environmental disruption. Geologists studying McDermitt have identified a recipe for similar deposits elsewhere, suggesting this discovery could reshape how the industry searches for lithium in volcanic terrains worldwide.

What happens next will test whether the world can extract critical minerals without repeating the mistakes of past resource booms. The deposit’s sheer size and accessibility make it tempting, yet the lived landscape around McDermitt, with its springs, wildlife, and cultural heritage, reminds us that geology alone does not determine whether a resource should be mined.

For a layperson-friendly overview of the McDermitt discovery and why it matters, see more at Earth.com. And investors may want more financial information. For that, read investor materials and project updates from Lithium Americas (LAC).