Free Spreadsheet Templates

Looking for spreadsheet templates to use in Google Sheets or Microsoft Excel? We made hundreds of them. If you’re looking for something specific, try our search.

Otherwise, browse our collection of articles on below. We always prioritize free templates.

Popular Spreadsheet Templates

Our experts have been crafting these tools for years. Here are some of our most popular spreadsheet templates.

Expense Tracker Template

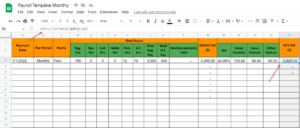

When you manage a business, it’s important to track expenses. That’s one reason we’ve seen so many small business owners embrace our Expense Tracker Template.

It’s made in Google Sheets, but you can also download it for other software. That makes it one of our most popular Excel spreadsheet templates.

Spreadsheet Template for Project Managers

Project management software is expensive. Google Sheets is free. That’s why so many project managers rely on our Project Management Templates.

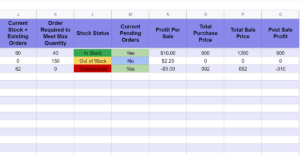

This collection includes action plan templates and task lists. For more specialized business spreadsheets, search our site for exactly what you need. These inventory templates, for example, help track unit quantities

They help track tasks from start to finish, with all the features needed to account for delays and new project requirements.

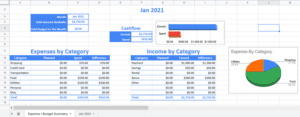

Budget Planner Spreadsheets

Everyone needs a budget, and everyone has unique circumstances. That’s what we considered when making our Budget Templates.

They’re fully customizable, and they’re built to track progress toward retirement (in addition to debt payoffs). These money management templates serve as a foundation for any personal financial plan.

Fitness Tracker Spreadsheets

Some people like to link smart devices with a mobile app and trust a third party with their health data.

For those who prefer to track their progress without that kind of oversight, we made several popular Workout Templates.

Calendar Spreadsheet Templates

Google Sheets Calendar Templates help us track employee schedules, project timelines, and even family vacations. They’re versatile and, with cloud-based spreadsheet software, they’re pretty easy to share.

And these are just the top five most popular spreadsheet templates. Our team consists of data analysts, programmers, financial experts, and writers. And they regularly add new spreadsheet templates below.

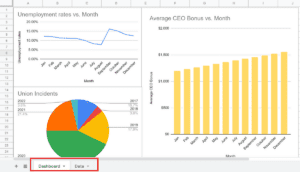

For example, check out this guide on how to make a Google Sheets dashboard. It includes how to import data from outside sources and then visualize data with charts on a single screen.