Sundar Pichai acknowledges “irrationality” in the AI boom and cautions that even tech giants face risk if valuations collapse.

In an exclusive interview with the BBC, Google’s parent company Alphabet CEO Sundar Pichai delivered a sobering message about the state of artificial intelligence investment. While calling the current AI boom an “extraordinary moment,” he warned that there is undeniable “irrationality” in how the industry is being valued. Most strikingly, when asked whether Google itself would be immune to an AI market crash, Pichai was blunt: “I think no company is going to be immune, including us.”

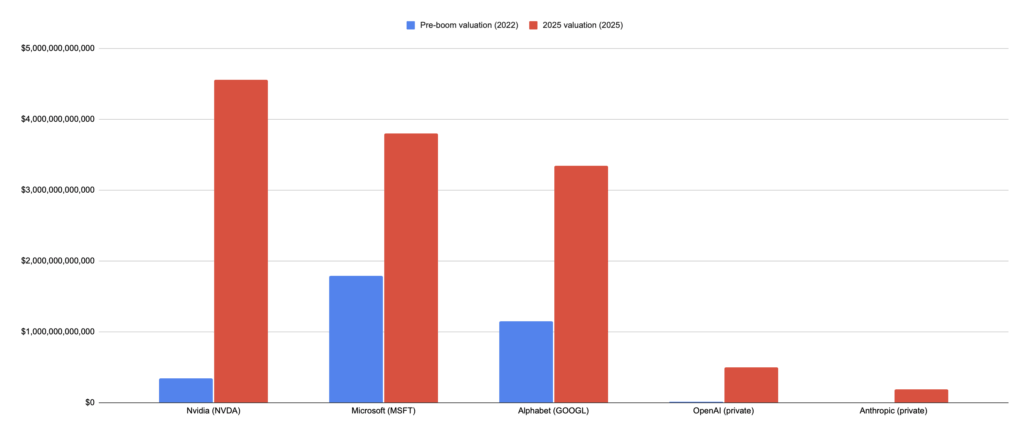

The warning comes as AI valuations have reached dizzying heights. Alphabet’s stock has surged roughly 50% this year, pushing its market value above $3 trillion, while Nvidia recently became the first company to hit a $5 trillion valuation. Yet beneath these soaring numbers lies a troubling reality.

Some analysts have flagged about $1.4 trillion in long-term infrastructure commitments tied to OpenAI, while the company expects around $20 billion in annualized revenue this year, a tiny fraction of that total. The comparison to the dotcom bubble of the late 1990s is hard to ignore, and Pichai himself invoked that parallel, echoing warnings once made by Federal Reserve chairman Alan Greenspan about “irrational exuberance.”

I analyzed the community response to Pichai’s comments since the interviews. Observers have raised concerns about the sustainability of current business models and questioned whether the tech industry’s massive spending will ultimately pay off.

Many commenters have drawn parallels to the 2008 financial crisis, expressing frustration about what they see as a pattern of privatized profits and socialized losses. There is palpable anxiety that if the AI market does contract sharply, ordinary workers and taxpayers could bear the burden while executives and investors walk away cushioned by their gains.

Pichai argued that Google’s integrated approach, owning everything from chips to data to frontier research, positions it better than competitors to weather market turbulence. He also emphasized that despite the cyclical nature of investment booms, the underlying technology remains transformative. “We can look back at the internet right now,” he said. “There was clearly a lot of excess investment, but none of us would question whether the internet was profound.” He expects AI to follow a similar trajectory: real and revolutionary, but accompanied by genuine waste along the way.

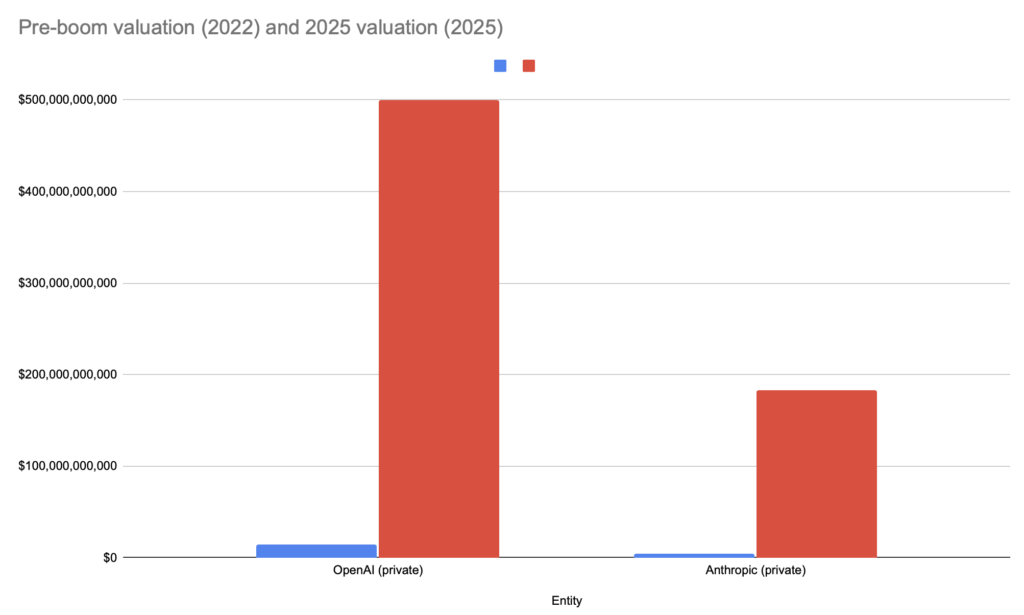

I also looked at the data behind the story. This visual representation comes from a quick bar chart in Google Sheets. It shows the change in valuation from the end of 2022 to recent valuations in 2025.

I looked at Nvidia, which makes the chips that power AI across industries, Microsoft, which is a cloud provider and OpenAI backer, and Google’s Alphabet, which has its own major AI efforts with Gemini. All of the companies boomed in value.

And the two private companies are worth a look by themselves. OpenAI and Anthropic alone have added roughly half a trillion in paper value in under three years, from $14B and $4.1B to $500B and $183B.”

The takeaway is one of cautious realism. Pichai’s candor about vulnerability, combined with his acknowledgment of irrational exuberance, suggests that even those steering the AI ship recognize the risks ahead. Some investors are taking their wins while the market is hot. Peter Thiel sold his Nvidia position recently, and arguments roiled online about financial markets bubbling around artificial intelligence technology.

Whether the industry can navigate a potential correction without triggering wider economic damage remains an open question, and the community’s skepticism reflects legitimate concerns about accountability and fairness in how such disruptions are managed.