It’s not the first place you’d look for a housing signal, but the NASDAQ may be sending a message to Detroit homeowners. Over the past decade, a consistent pattern has emerged: when tech stocks post strong gains in Q1, Detroit housing prices tend to stall, or even fall.

The connection isn’t just academic. With a correlation coefficient of -0.86, the relationship is one of the strongest inverse trends among U.S. housing markets.

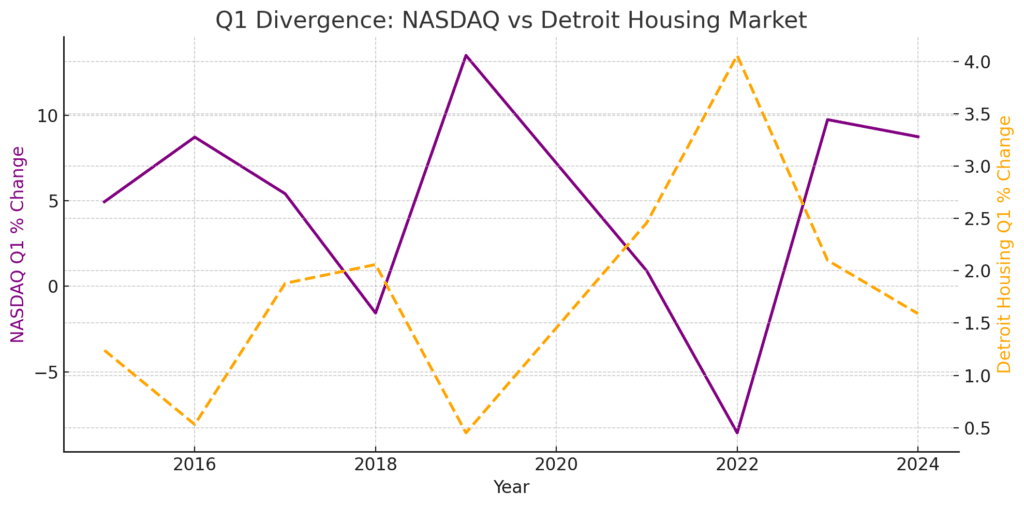

So why does this happen? The chart below makes the pattern clear. The purple line shows NASDAQ Q1 percentage changes.

The orange dashed line tracks Q1 housing price growth in Detroit. In years like 2018 and 2023, the gap between these lines is dramatic, tech surged while housing stagnated. In fact, during every year with major NASDAQ growth, Detroit home price gains either flattened or declined.

Why The Trend?

The leading theory: capital flow. Detroit is a market where housing often attracts value-focused or opportunistic investors. When the NASDAQ is on fire, those same investors may redirect their dollars toward high-performing equities instead of physical real estate. The result? Detroit’s housing market loses momentum, even when broader economic conditions look favorable.

We saw this play out in 2023 (and we evaluated the past decade for trends relating gold vs. real estate prices). Tech stocks posted major Q1 gains, and Detroit housing growth barely topped 1.5 percent, despite a strong labor market and moderating mortgage rates. Similarly, in 2018, the NASDAQ dropped in Q1 and Detroit responded with its best housing performance of the decade.

The opposite pattern also appears. In 2022, when NASDAQ dropped sharply in the first quarter, Detroit housing saw its most robust Q1 growth in years, rising over 4 percent. That flip in behavior strengthens the case that Detroit’s real estate market may be more sensitive to Wall Street momentum than previously thought.

Last year, in 2024, the NASDAQ was up again. And that was by more than 12 percent in Q1. It plummeted, obviously, at the start of this year. The drop was due to uncertainty over erratic tariff plans, and investors from January through March had not yet experienced the full brunt of the looming Trump tax.

Of course, housing is never about just one variable. Mortgage rates, inventory, wages, and local policy still shape the landscape. But for those keeping an eye on Detroit real estate, tech market rallies may now be part of the forecasting toolkit.

Sometimes, the most revealing signals come from unexpected places. And in Detroit, what happens on Wall Street might be the clearest clue of what’s next for Main Street.