Manhattan is on pace to top 40M sq ft of leasing, and we’ll get into the data. Top commercial real estate executives are not just waving away concerns that New York’s new mayor-elect will drive business out of the city. They are pointing to numbers that suggests the opposite is happening.

When Zohran Mamdani, a democratic socialist, won New York City’s mayoral race, critics predicted capital flight and darkened towers. But at CNBC’s Delivering Alpha conference, RXR CEO Scott Rechler and Rudin Management co–executive chairman Bill Rudin argued that the market is not behaving like a city on the brink. It is behaving like one of the strongest office markets in the country.

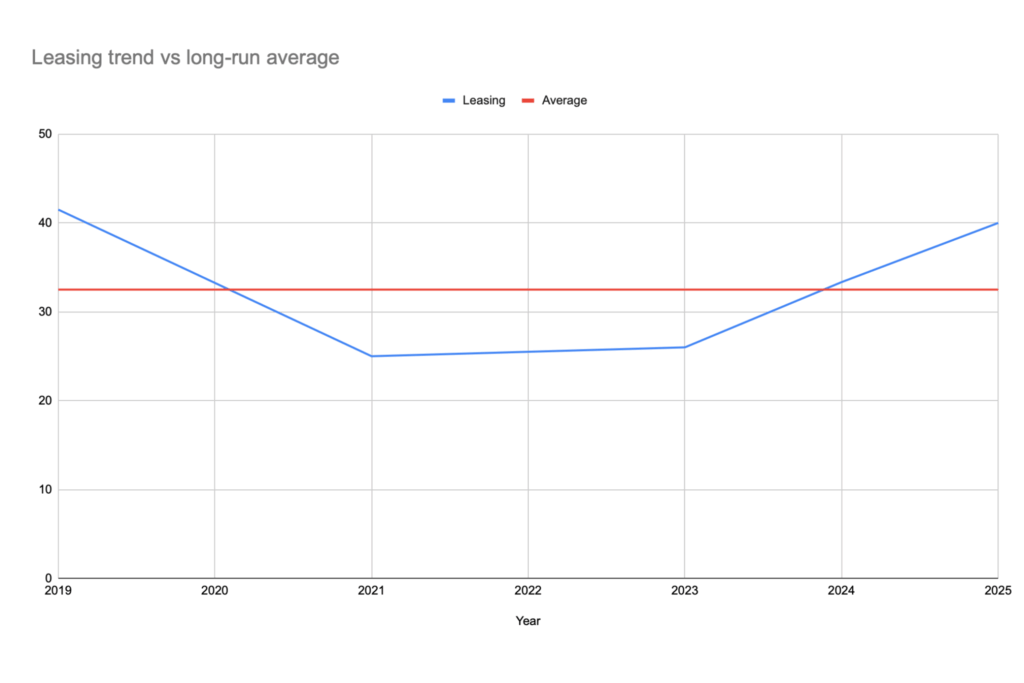

Rudin said Manhattan office tenants are on pace to lease more than 40 million square feet of space this year. That claim lines up with recent brokerage data. Colliers puts full year 2024 leasing at 33.34 million square feet, the strongest demand in five years and still roughly one fifth below 2019’s peak.

Its October 2025 snapshot notes that year to date activity has already surpassed the 2024 total and is on pace to exceed 40 million square feet for the first time since 2019 if current momentum holds, with availability tightening and sublet supply dropping below pre–pandemic levels. Colliers’ Q4 2024 report and its October 2025 snapshot spell out those numbers in detail.

Other market trackers tell a similar story. Commercial Observer reports that Manhattan’s first quarter 2025 leasing, at roughly 11.4 million square feet, was the strongest quarter since late 2019 and marked a fourth straight increase in demand. And this happens at a time when at least one professor calls out policy similarities to 1929.

Savills and Crain’s New York have highlighted that companies have already leased more than 30 million square feet through the third quarter, the highest year to date figure since the early 2000s and on track to match or beat 2019’s roughly 41.5 million square feet. Commercial Observer, Savills, and Crain’s all describe a market that is healing faster than the national narrative would suggest.

Rechler describes a sense of urgency among tenants that rarely shows up in political arguments about “anti–business” leaders. Some leases that used to take a year to negotiate are now getting signed in three weeks. Companies that once hesitated are front loading their real estate decisions, locking in space through 2028, 2030, and beyond.

The headline projects tell a similar story. The Wall Street Journal notes that JPMorgan’s new 270 Park Avenue headquarters is a three billion dollar, 2.5 million square foot tower that can accommodate about 10,000 employees and stands as a symbol of New York’s office recovery. JPMorgan’s tower is part of a broader wave of high–end commitments from firms like Deloitte, Citadel, Blackstone, and others that have expanded in Manhattan rather than shrink their presence.

What the numbers say about “NYC is over” moments

To see how much the current panic lines up with reality, it helps to put some key years in one place. Brokerage reports and landlord commentary give a rough time series of how much space tenants actually commit to in a given year. The table below lines up five moments when pundits said New York was finished with the actual leasing volumes on the ground.

| Year | Narrative | Gap vs long run average |

|---|---|---|

| 2019 | Pre–pandemic peak | Roughly 25 to 30 percent above average |

| 2021 | Covid hangover | Roughly 20 to 25 percent below average |

| 2023 | High rates | Roughly 20 percent below average |

| 2024 | Recovery year | Back to the 25 year average of about 32 to 33M |

| 2025 (projected) | Mamdani fears | Roughly 20 to 25 percent above average |

The pattern is straightforward. Leasing slumped during the pandemic, stayed weak into 2021 and 2023, then returned to normal in 2024 and is now on track to break above normal in 2025. Colliers and CRE Daily both note that 2024’s 33.34 million square feet brought Manhattan back to its 25 year average of roughly 32 to 33 million.

Colliers’ October snapshot shows 2025 year to date demand already above that full year 2024 figure and on pace for a total above 40 million if the current run rate holds.

In other words, the moment when critics say New York is about to drive business away under a left wing mayor is also the moment when tenants are taking more space than they have in years.

For readers who want to build their own charts, it is not hard to re–create this table in a spreadsheet and layer in your own assumptions. A basic model that tracks annual leasing, vacancy, and absorption can be put together with a few columns and SUMIFS formulas. Guides like this explanation of the SUMIFS function in Google Sheets make it much easier to pull multiple years of leasing data into a clean dashboard.

None of this means Mamdani’s agenda is irrelevant. Rechler says that when he travels overseas, questions about the mayor–elect now dominate meetings with institutional investors, especially those looking at multifamily housing. Talk of higher taxes and rent freezes is already leading some groups to stall or rethink projects.

However, the political noise has to be measured against the institutional reality of how New York is run. A mayor can propose new levies on the wealthy, but the state legislature has to approve many tax changes. Rent regulation is shared between Albany and city agencies.

For now, the leasing numbers are clear. In a year when critics say New York is about to punish business, tenants are signing deals at a pace that could push Manhattan above 40 million square feet of office leasing for the first time since 2019. The politics may have shifted. On the spreadsheet, the city’s office market looks very much alive.

Anyone who wants to stress test that optimism can build a simple scenario model that ties leasing volume, vacancy, and effective rent into a basic revenue projection for Midtown or Downtown. A flexible template, such as a Google Sheets budget template combined with a rent calculator spreadsheet, can turn this story into a living model you adjust every quarter as new data arrives.